U.S. Dollar Crashes

to Three-Year Low Amid Tariff Uncertainty

By the Curmudgeon with Victor

Sperandeo

Introduction and

Overview:

It’s not supposed to be like this! Trump’s tariff trauma,

chaos and the ensuing sharp financial market declines should be strengthening

the U.S. dollar -- the world’s reserve currency-- in a flight to safety. Geopolitical and economic uncertainties

globally tend to increase the demand for safe-haven currencies like the U.S.

dollar. Yet the dollar not only failed to strengthen during the post April 2nd

all-asset (x-Gold) meltdowns, but it also fell

sharply, puzzling economists, foreign holders of (unhedged) U.S. assets,

and hurting consumers.

Most economists believed the dollar would strengthen for several reasons:

1.

Tariffs are a tax, which would

reduce demand for more expensive foreign products thus lowering demand for

foreign currencies, and consequently, strengthening the dollar.

2.

The tariffs were expected to

be inflationary, potentially leading to higher bond yields and fewer rate cuts

by the Federal Reserve Board. U.S. interest rates higher than foreign rates

would attract more investment into dollar-denominated assets, strengthening the

dollar.

3.

Finally, Trump

administration policies aimed at boosting domestic manufacturing and

deregulation could also contribute to a stronger dollar. What a shocker!

Here are

the cold, cruel statistics:

·

The dollar lost more than 5%

against the euro and pound, and 6% against the yen since early April.

·

Foreign funds sold $10.7

billion in U.S. stocks between April 3rd (first day of trading after

Trump’s “Liberation Day” announcement) and April 9th (when Trump

announced a 90-day pause on some tariffs). U.S.-based funds were net buyers of

$37.5 billion in U.S. stocks in that period.

·

Foreign funds sold an

estimated $14.2 billion from U.S. Treasuries and corporate bonds in the two

weeks ending April 16. In the same period, U.S.-based funds had outflows

of $11.4 billion from U.S. fixed income.

·

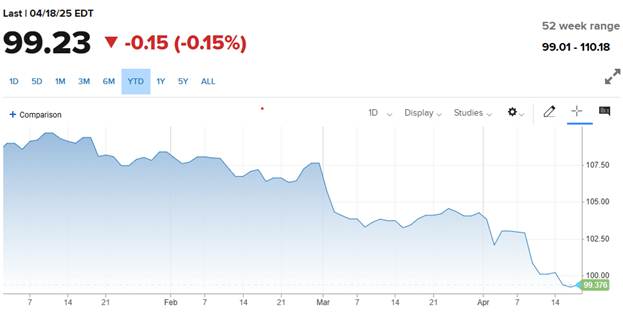

Since mid-January, the dollar

has fallen 9 to 10% against ICE U.S.

Dollar Index (DXY). That’s a rare and steep decline to its lowest level in

three years and the worst start to a year in the index’s four-decade trading

history.

Here’s the DXY 2025 YTD chart:

·

The trend of U.S. bond sales

from China, Japan and other countries is likely to continue to put downward

pressure on the dollar as will foreign investors who have been selling U.S.

stocks and other dollar assets this year.

·

European interest rates have

come down substantially since April 2nd, while U.S. intermediate and

long-term rates have risen. Interest rate differentials widened which should’ve

favored the dollar as a higher yielding fixed income investment.

·

For example, the German

10-Year Bund rate fell from 2.8826% to 2.463% while the U.S. 10-Year Treasury

Note rate INCREASED from 4.03% to 4.34% currently. Therefore, the interest rate difference

between the 10-Year T-Note and the 10-Year Bund has increased to approximately 1.88 percentage points (4.34% - 2.46%).

Negative Implications of

the Declining Dollar:

Now the price of French wine, Japanese cars and parts, South

Korean electronics (e.g. Samsung, LG, SK Hynix, etc.) and a host of other

imports will cost a lot more - not only due to tariffs but also to a weaker

currency.

The sharp dollar decline could also hit U.S. consumers in higher

interest rates for mortgages and car financing deals as lenders demand higher

interest rates for the added risk.

More worrisome is possible higher interest rates on the

ballooning U.S. federal debt, which is

already at a very risky 120% of U.S. annual economic output (GDP). Federal interest expenses have already

eclipsed both Medicare and military spending and are headed higher unless the

dollar stabilizes.

Debt financing costs are invincible - they can’t be cut by

DOGE, Congress or any government agency.

Sorry President Trump, no Executive Orders will be possible!

“Most countries with that debt to GDP would cause a major

crisis and the only reason we get away with it is that the world needs dollars

to trade with,” said Benn Steil, an economist at the Council on Foreign

Relations.

…………………………………………………………………………………………………………………………………

Importance of the U.S.

Dollar for Consumers and the Markets:

The U.S. dollar’s dominance in cross-border trade and as a safe haven has been nurtured by administrations of both

parties for decades, because it helps keep U.S. borrowing costs down and allows

Washington to project power abroad — enormous advantages that could possibly

disappear if faith in the U.S. was damaged.

The dollar's special status as the global currency king dates back to 1944,

giving America extra perks worldwide, according to the Council on Foreign Relations. Central banks worldwide stash nearly

60% of their reserves in dollars. Every major commodity—from oil to soybeans to

computer chips—trades in dollars, allowing America to borrow cheaply and

leverage its diplomatic power by controlling access to financial markets

trading in dollars.

Economists critical of Trump’s April 2nd “Liberation

Day” tariff announcement recall another event, the Suez Crisis of 1956, that broke the back of the British Pound Sterling. The military

attack on Egypt was poorly planned and badly executed and exposed British

political incompetence that sank trust in the UK. The Pound fell sharply, and

its centuries-long position as the dominant trading and reserve currency

crumbled.

UC Berkeley Economics Professor Barry Eichengreen

says Liberation Day (April 2nd), could be remembered as a similar

turning point if the president isn’t careful. “This is the first step down a

slippery slope where international confidence in the U.S. dollar is lost.”

“Global trust and reliance on the dollar was

built up over a half century or more. But it can be lost in the blink of an eye,”

he added. That seems to be happening now!

Curmudgeon Opinions:

One would think U.S. Treasury Secretary Scott

Bessent, a currency expert [1.] and former hedge fund

manager, would be aware of the dangers posed by the dollar’s decline and

convince Trump to moderate his universal tariffs and vicious trade war against

China. But that has not happened. No

actions have been taken by the U.S. administration to stop the dollar’s rapid

decline (see Victor’s comments below).

……………………………………………………………………………………………………………………………….

Note 1. Bessent

was a leading member of the Soros Fund Management team whose bet on the

1992 Black Wednesday collapse of the British pound garnered over $1 billion for

the firm. His bet against the Japanese yen in 2013 brought additional profit.

……………………………………………………………………………………………………………………………….

It’s also a mystery why billionaire U.S. Commerce Secretary Howard Lutnick is not

concerned that 145% tariffs on China exports will kill U.S. big tech companies

(like Apple, Google, Amazon, Microsoft, Facebook, etc.) whose supply chains are

mostly in China and Taiwan. That’s not only for semiconductors and smartphones,

but also for the powerful computer servers and other IT equipment used by the

cloud hyper-scalers.

On Sunday, April 13th Lutnick said that the

administration's decision Friday night April 11th to exempt a range

of electronic devices from tariffs implemented earlier this month was only a

temporary reprieve. The Commerce Secretary

announced that those items would be subject to "semiconductor

tariffs" that will likely come in "a month or two."

"All those products are going to come under

semiconductors, and they're going to have a special focus type of tariff to

make sure that those products get re-shored. We need to have semiconductors, we

need to have chips, and we need to have flat panels -- we need to have these things made in America (???). We can't be

reliant on Southeast Asia for all the things that operate for us," Lutnick

told "This

Week."

à It is INCREDIBLY

NAÏVE to believe that U.S. high tech manufacturing can be rebuilt after

they’ve been increasingly off shored for the last 25 years. The U.S. does not have the required

infrastructure or skilled low-cost labor that would make that possible anytime

soon and certainly NOT during Trump’s 2nd term of office.

Non-Dollar Alternatives

for Global Trade:

China has been striking yuan-only trading deals with Brazil

for agricultural products, Russia for oil and South Korea for other goods for

years. It has also been making loans in yuan to central banks desperate for

cash in Argentina, Pakistan and other countries, replacing the dollar as the

emergency funder of last resort.

For years, there’s been talk of a BRICS currency, but that

hasn’t happened in any way, shape or form.

Victor speculated on that topic in this

post, but there's been no official move towards creating it.

Victor’s Comments:

A few points of order … the dollar will not be replaced as the

world reserve currency, because nothing else can replace it. That’s due to the

depth of the U.S. debt markets, trading liquidity, and open borders. However,

the dollar will decline at times - always due to fundamental factors that are

usually not known or misinterpreted.

The Main Street Media (MSM)

is the absolute worst place to find out the reality and truth of the cause of

events. You must do it on your own or find independent resources of information

that you trust and have shown to be correct in the past (like the Curmudgeon/Sperandeo

blog posts).

The dollar is now in a steep downtrend and is not a place for

foreigners to park money as a safe haven. Why? The main reason is Trump’s policies on

“investments” and China are being turned upside down. In effect, the Trump administration is now

saying to China:

“Take your money out of the U.S. Your Investments in the U.S.

are not welcome, under your designs and political goals, which are

anti-America.”

Please read the “America First Policy Investment Memo of 2/21/25”

for a more definitive answer. That memo

provides the critical reason for the trade war with China and why the dollar is

falling and will continue down.

“Investment at all costs

is not always in the national interest, however. Certain foreign

adversaries, including the People’s Republic of China (PRC),

systematically direct and facilitate investment in United States companies and

assets to obtain cutting-edge technologies, intellectual property, and leverage

in strategic industries. The PRC pursues these strategies in diverse

ways, both visible and concealed, and often through partner companies or

investment funds in third countries.”

A lower dollar is conducive with Trump’s policy of lowering

the U.S. trade deficit by making U.S. goods cheaper! I am guessing that the 90-price

level on the DXY is the desired target. This will be achieved slowly and

surely over time. It also will come from lower U.S. interest rates.

A tariff is a tax. Taxes are not included in the CPI! It usually is a one-time event,

and some prices don’t rise if the manufacturer can absorb it. Prices rise for

all kinds of reasons (that have nothing to do with inflation e.g. printing

paper fiat currency). A recent example is the egg shortage due to Bird Flu

killing 20 million hens.

What if Trump Fires Fed

Chair Powell?

Trump has also repeatedly threatened to chip away at the

independence of the Federal Reserve, raising fears that he will force interest

rates lower to boost the economy even if doing so risks stoking runaway

inflation. That is a sure-fire way to get people to flee the dollar. After Fed

Chair Jerome Powell said Wednesday that he would wait to make any rate moves,

Trump blasted him, saying “Powell’s termination cannot come fast enough!”

Democratic Sen. Elizabeth Warren, a frequent critic of

Powell, said during an interview on CNBC that firing the Fed chair could cause

U.S. markets to crash.

Steve Sosnick, chief strategist at Interactive Brokers, said

any decision that compromises the independence of the Fed could deter foreign

investors from investing in U.S. markets.

“I believe that we underestimate how important many of our institutions

are to international investors. Those include a nonpartisan judiciary and a

central bank that is immune to political meddling,” Sosnick said.

“There’s already a concern that foreigners have been

retreating from our stock and bond markets, and this certainly won’t do

anything to assuage those concerns,” he added.

Victor’s Opinion: The war with Fed Chair Powell will be won by

Trump as he controls the bully pulpit, and six of the seven institutions of

U.S. government power (the House, Senate, the Supreme Court, the States

(aggregate of Governors) and the aggregate of legislatures.

However, Trump does not control The Fed! He legally

cannot fire Powell, but he can apply so much political pressure on the Fed that

Powell will resign. Think about the Speaker of the House calling for the repeal

of the 1913 Federal Reserve Act? The

ammo Trump has is global central banks are lowering rates (the ECB cut rates to

2,25% for the 7th cut in a row). The 2-year Treasury Note, which tracks the Fed

Funds rate most of the time is 3.81% while Fed Funds are 4.4%? The 10-year

yield is even lower at 4.34%. The markets seem to agree with Trump that U.S.

short term rates will soon be lower.

If Trump gets his way with tariff negotiations it is possible

(but not probable) that prices in America will decline, as tariffs could come

down from 20% in the Euro Zone and Japan to zero. This is unknown and could go

either way.

…………………………………………………………………………………………………

Conclusions:

Trump’s erratic, unpredictability makes the U.S. seem less stable,

less reliable, and a less safe place for their money.

Trump says U.S. tariffs will drive down trade deficits, which

he cites as evidence that countries are “ripping off” America. But in

calculating the tariffs, he looked at trade deficits only in goods, not

services in which the U.S. excels. Most economists think trade deficits are not

a sign of national weakness anyway because they do nothing to impede economic

growth and prosperity. Also, countries

hit with tariffs will reciprocate as China already has done.

There seems to be a huge

contradiction in the U.S. Memo

Victor referenced above:

“Section 1. Principles and Objectives. America’s investment policy is critical to

our national and economic security.

Welcoming foreign investment and strengthening the United States’

world-leading private and public capital markets will be a key part of

America’s Golden Age.”

-->The U.S. imposed tariffs and falling dollar are

certainly discouraging - NOT encouraging - foreign investments. Financial asset

meltdowns due to great U.S. government policy uncertainty are weakening - not

strengthening - U.S. private and public capital markets. It’s

all convoluted and super scary!

Athanasios Vamvakidis, global head of G-10 foreign exchange

strategy at Bank of America said if there is a favorable turn in U.S. policies,

the dollar could benefit.

“But I don’t think we go back to where we were because I

think the rest of the world has crossed

a red line, and they will try to reduce dependence on the U.S. on trade, on

defense and everything. There’s no way back,” he said.

“The status of the dollar as the world’s premier reserve

currency is being questioned because of the policy decisions of the Trump

administration. Following so-called Liberation Day on April 2nd, the

chaotic rollout of President Donald Trump’s tariff policy has resulted in

declines in the dollar and prices of longer-term U.S. government securities in

tandem with declines in risky assets such as stocks—a reaction contrary to the currency’s and Treasuries’ usual performance as safe havens

during episodes of market volatility.”

“To paraphrase F. Scott Fitzgerald (The

Great Gatsby), we are careless people, willing to smash things up,

including the status of the dollar.

News Flash:

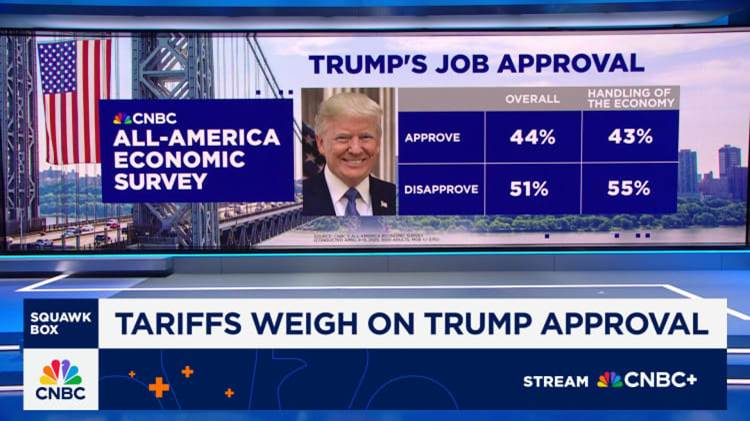

Donald Trump’s economic approval rating has plummeted ever

since imposing tariffs. A CNBC

survey released Saturday shows 55% of Americans disapprove of his

handling of the economy, the lowest point it’s been during both his first and

second term as U.S. President. That’s

the first time in any CNBC poll Trump’s approval has been net negative on the

economy.

…………………………………………………………………………………………………………………………………….

End Quote:

Always keep in mind the trading words of legendary investor George Soros:

“Economic history is a never-ending series of episodes based

on falsehoods and lies -NOT TRUTHS! It represents the path to big profits. The

object is to recognize the trend, whose premise is false, ride that trend and

step off before it is discredited.”

…………………………………………………………………………………………………………………………….

Stay calm (easier said than

done), be well, success and good luck. Till next time…

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever-changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).