U.S. Stocks and

the Dollar – United They Fall!

By the Curmudgeon

A brief follow-on to yesterday’s

Curmudgeon post:

1.

NY Times (print) page 1 story today: “Trump Has Added Risk to the Surest Bet in

Global Finance”

Shocked by Trump’s trade war, foreign investors are selling

U.S. government bonds, long the world’s safe haven.

2.

“Trump claims he’s ‘solved’ his bond market problem, but

he really hasn’t”

Asked specifically about the bond market, Trump said, “The

bond market’s going good. It had a little moment, but I solved that problem

very quickly. I am very good at that stuff.”

Every element of this was wrong. The bond market is most

certainly not “going good.” It had more than “a little moment.” Far from

“solving” the problem, he actually created it. The threat did not pass “very

quickly.” And to the extent that Trump is “very good” at anything, it clearly

is not this “stuff.”

In times of tumult, U.S. Treasury bonds are the international

safe haven for investors. Even when the United States has been the cause of an

economic crisis — such as the 2008 crash that resulted in the downturn known as

the Great Recession — investors and financial institutions around the world

still turned to U.S. government bonds.

3.

From Fidelity’s Jurrien Timmer’s LinkedIn post:

“If a trade war morphs into a capital war, then there’s more

at stake than tariffs.”

The action in the bond market was especially choppy as a lack

of liquidity made it harder to unwind leveraged trades. Should the bond market

remain disorderly, it wouldn’t surprise me at all if the Fed steps in to buy

bonds, not as a policy directive (QE) but in its role to maintain orderly

markets and provide liquidity.

If so, it would be taking a page from the Bank of England,

which in 2022 had to restore order to the GILT market after the then PM Liz

Truss fiasco. In the end, the BoE only

had to buy $19 billion in long GILTs and was able to sell them a few months

later.

………………………………………………………………………………………………….

Post “Liberation Day”

Message: Stocks and U.S. Dollar Fall

Together:

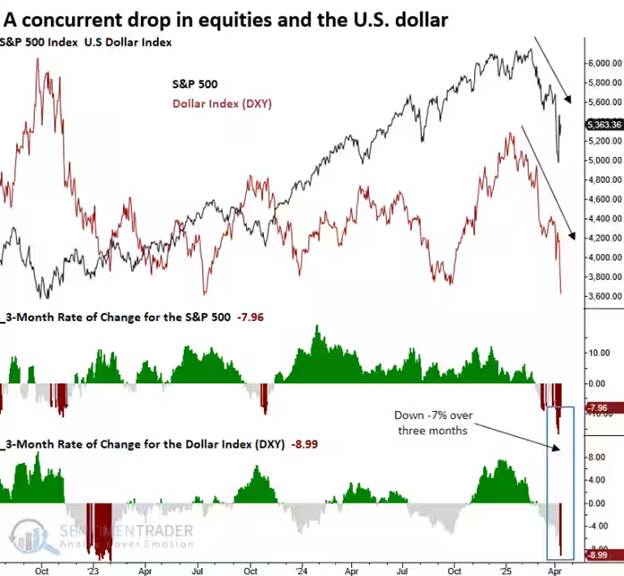

A picture is worth a thousand words:

The past three-month rate of change for the S&P 500 was -7.96% over, noted Dean

Christians, senior research analyst at SentimenTrader,

in a Monday note to subscribers. The rate of

decline for the ICE U.S. Dollar Index (DXY),

a measure of the currency against a basket of six major rivals, was -8.99%.

[The Curmudgeon has a small, short DXY position.]

“Over the past three months, the S&P 500 and the U.S.

dollar have declined in unison, a rare and notable development given that the

dollar typically strengthens during risk-off periods when equity markets

retreat,” Christians said.”

They found eight instances going back to 1973. Past episodes

have tended to occur during periods of uncertainty, “often pointing to market

stress or geopolitical tensions that trigger capital repatriation, not the

dollar’s demise,” Dean wrote.

“Currently, investors are likely witnessing a repatriation flow, with

foreign investors seeking the safety of their home countries,” he said. Tariffs

have served as the trigger, with rising trade tensions injecting uncertainty

into global markets.

In six of the eight previous incidents of simultaneous

declines, the S&P 500 went on to post a lower low, with only 1978 and 1998

coinciding with a market bottom, according to SentimenTrader.

“With six of the last eight instances resulting in a lower

low for the S&P 500, maintaining a cautious stance and waiting for a more

favorable entry point appears prudent,” Christians said.

………………………………………………………………………………………….

Stay calm, success, good luck and till next time……………..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).