Safe Havens No

More: U.S Bonds and the Dollar?

By the Curmudgeon

Introduction:

It’s important to understand that yields on U.S. 10-year Treasury

notes determine borrowing costs for everything from the $12.6 trillion U.S.

mortgage market to $5.8 trillion in bank lending to businesses as well as the

ever-increasing U.S. Treasury Department's own interest bills. Significantly, U.S. government bills continue

to increase geometrically due to huge budget deficits and mounting interest on

the entire national debt.

Trump and Bessent Focused on 10-year U.S. Treasury -

Really???

On February 6th, U.S. Treasury Secretary Scott Bessent told Fox Business

"The president wants lower interest rates and ... in my talks with him, he

and I are focused on the 10-year Treasury. He believes that if we ... deregulate the

economy, if we get this tax bill done, if we get energy down, then rates will

take care of themselves, and the dollar will take care of itself."

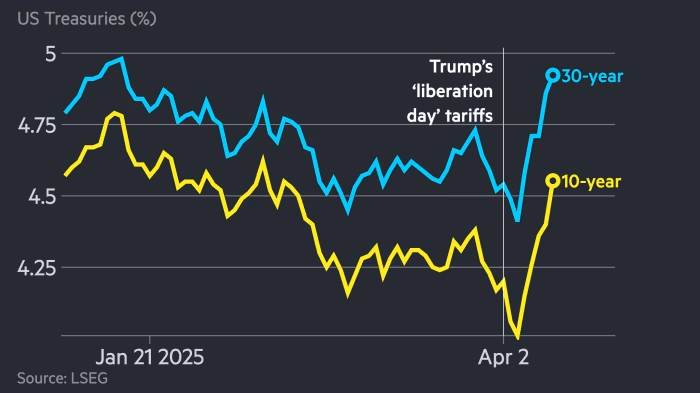

Major U -Turn in U.S. 10 and 30-Year Rates Last Week:

Last week was a golden opportunity for the U.S. 10-year yield

to drop significantly. Instead, it leaped ~58 basis

points week-over-week (from ~4% on Friday April 4th to 4.58% on

April 11th ). -->That was the biggest

rise in U.S. 10-year yields since 2001, according to Bloomberg data!

Fixed income and futures traders said poor liquidity — the

ease with which investors can buy and sell Treasuries without moving prices —

was exacerbating market moves.

Analysts at JP Morgan said market depth, a measure of

the market’s ability to absorb large trades without significant shifts in

price, had significantly worsened this week, meaning even small trades were

moving yields significantly.

The head of U.S. Treasury trading at a major U.S. bond

manager said liquidity was “not great today” (incredible understatement) and

explained that “market depth was running 80% below normal averages” on Friday.

What a conundrum as economic statistics were all very bullish for bonds:

·

U.S. CPI and PPI readings for

March came in way below expectations and probably clears the path for the Fed

to cut rates, possibly as soon as next month.

·

The CPI fell to 2.4% in March, which was below both February’s reading

of 2.8 per cent and the 2.5% forecast by economists polled by Bloomberg.

·

The PPI fell 0.4% last month from February, the Bureau of Labor Statistics (BLS) said on Friday, much lower than

economists’ expectations of an 0.2%. On a yearly

basis, the PPI slowed to 2.7%, from 3.2% in February. Economists had expected a

3.3 per cent increase.

·

The annualized headline

inflation rate is down to 2.4% and the core rate fell to 2.8%, the first time

it’s been below 3% in four years.

·

The University of Michigan’s consumer sentiment index fell to a

preliminary reading of 50.8 in April, the fourth straight monthly drop.

Economists had forecasted a much smaller decrease to 54.5 from 57 in March.

·

Economists have ratcheted

down U.S. GDP growth expectations, while many investment banks (like JP Morgan

Chase) say there’s a 60% chance of recession this year. Slower economic growth reduces credit demand.

·

The current unemployment rate

is 4.2% and poised to rise. The tech sector shed 29,000 jobs in March. According to CompTIA, a nonprofit

information technology association that analyzes data from the U.S. Bureau of

Labor Statistics, the downturn was expected as ongoing global tariff

disputes and economic uncertainty have created a challenging hiring

environment for the tech industry.

It seems very likely that China and Japan were successful in driving U.S. rates higher by

dumping Treasuries on the market starting early Monday morning. That’s despite stock prices diving lower that

day. It was surely the key data point that caused Trump to pause tariffs for

90-days on all countries except China.

It’s hard to say if China has the upper hand now in trade

negotiations, but they could further disrupt already strained global financial

markets by selling more U.S. notes and bonds.

Bottom Line: U.S.

Treasury debt’s safe haven status is being upended as

investors around the world question the stability of U.S. markets.

Quotes on U.S. Treasury

Securities:

“There is real pressure across the globe to sell Treasuries

and corporate bonds if you are a foreign holder,” said Peter Tchir, head of US

macro strategy at Academy Securities.

“There is a real global concern that they don’t know where Trump is going.”

“We are concerned because the movements you see point to

something else other than a normal sell-off,” said a European bank executive in

prime services, a division that facilitates leveraged trading for firms

including proprietary traders and hedge funds. “They point to a complete loss

of faith in the strongest bond market in the world.”

“Long-end U.S. rates are on a mushroom trip, and there’s no

interrupting that with any economics right now." said Ed Al-Hussainy at Columbia

Threadneedle Investments.

“If a stiff breeze blew through the Treasury market today,

rates would move a quarter point,” added Guy LeBas, chief fixed-income

strategist at Janney Montgomery Scott.

Barclays’ Ajay Rajadhyaksha title

notes: “This is not normal. Bond markets are in trouble.”

The key questions are around the indirect damage done through

generating extreme uncertainty around the policy and economic outlook, the

ongoing dislocations in the US Treasury market and, ultimately, undermining

confidence in US institutions and asset markets. It is too soon to say what the

longer-term effects of the past ten days’ turmoil will be, and there is still

time for damage limitation by policymakers. But, in our view, it is no longer

hyperbole to say that the dollar’s reserve status and broader dominant role is

at least somewhat in question, even if the inertia and network effects that

have kept the dollar on top for decades are not going away any time soon and

our base case is that it will recover to some degree.

…………………………………………………………………………………………………

U.S. Dollar Suffers Huge Decline:

Friday’s Treasury volatility was accompanied by a big drop in

the dollar. A gauge of the U.S. currency’s strength against major peers fell as

much as 1.8% on Friday. UK Pound Sterling, the Japanese yen and the Swiss franc

all made significant gains.

Obviously, the U.S. dollar is weakening due to Trump’s tariff

turmoil and flip-flops which create uncertainty and chaos. Instead of being the usual safe

haven in times of financial stress and great uncertainty, the dollar is

becoming the currency to sell. That could be the shotgun start for a much

broader shift of capital away from the US, according to Wellington Management, which manages more than $1tn in client

assets.

“From a global investor perspective, such a scenario would

imply that the U.S. no longer offers the same protection against rising

inflation,” said John Butler, macro strategist.

“If the Fed keeps rates elevated to combat above-target

inflation, it will face increased political pressure, which could undermine its

credibility, which again is a negative for investors,” he said.

Conclusions:

For over 20 years, the U.S. has benefited from almost

relentless flows into US $ denominated financial assets. Bonds, equities,

credit, the U.S. dollar all have benefited. Coming into 2025, the U.S. was

about 25% of world GDP and 65% of global equity market capitalization. Was

that a high-water mark?

The price action of the past five days suggests that there

may be a gradual move in capital away from U.S. assets. And that trend could

accelerate if the disruptive Trump tariff and immigration policies continue

unabated.

Investors are now raising questions that would have

previously been preposterous.

In a Friday report to clients, Evercore ISI’s Sarah

Bianchi says that the disruption and uncertainty unleashed by the Trump

administration in its first two months is so extreme that even a full rollback

of its trade policies probably wouldn’t matter.

While tariff policy is the proximate cause, she opines that the U.S. is

now upending the global trading system it built over decades.

A very real concern is that while Trump may be able to cut a

few tariff deals, when the issue is a broader loss of confidence in the United

States, even a much fuller retreat on trade might not work.

The global financial system has never been subjected to such

turmoil, chaos and uncertainty before.

Yes, that also includes the 2008-2009 mortgage meltdown/ financial

crisis.

Closing Quote (emphasis added):

From Jonas Golterman, Capital

Economics Friday note, “How to lose a safe haven status in 10 days:”

“After another tumultuous week across financial markets, the

dollar is on track for one of its worst weeks on record. At this point, the

main question for the dollar is no longer what the direct effects of President

Trump’s tariffs will end up being. Rather, the key questions are around the indirect

damage done through generating extreme uncertainty around the policy

and economic outlook, the ongoing dislocations in the U.S. Treasury market and,

ultimately, undermining confidence in U.S. financial institutions and asset

markets.”

….…………………………………………………………………….

Stay calm, success, good luck and till next time……………..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).