Update on Credit Spreads and a Possible Top in Junk

Bonds

By the

Curmudgeon

In our last column, we noted U.S. credit spreads were

at or close to all-time lows. Among

other comments were the following:

·

The average U.S.

investment-grade spread was at just 0.83 percentage points on January 8th, not

far above its narrowest point since the late 1990s, according to ICE BofA.

·

To take advantage of tight

spreads, corporate borrowers kicked off the first week of 2025 with a record

$83B in bond sales.

·

There are a lot of risks to

spreads inflation picking up, the economy slowing down, the Fed potentially

pausing rate cuts and even moving on to rate hikes, said Maureen OConnor,

global head of Wells Fargos high-grade debt syndicate. Evidently, the bond market is not too

concerned about those risks, but it is pushing yields on U.S. Treasury notes

and bonds substantially higher. Thats a

super conundrum to the Curmudgeon???

Heres an update from the St.

Louis Fed:

The current OAS spread is at 2.72% as of January 15, 2025,

just of an all-time low of 2.61% in December 2024.

Notes:

The ICE BofA

Option-Adjusted Spreads (OASs) are the calculated spreads between a

computed OAS index of all bonds in a given rating

category and a spot Treasury curve. An OAS index is constructed using each

constituent bond's OAS, weighted by market capitalization. The ICE BofA High

Yield Master II OAS uses an index of bonds that are below investment grade

(those rated BB or below).

This data represents the ICE BofA US High Yield Index value,

which tracks the performance of US dollar denominated below investment grade

rated corporate debt publicly issued in the US domestic market. To qualify for

inclusion in the index, securities must have a below investment grade rating

(based on an average of Moody's, S&P, and Fitch) and an investment grade

rated country of risk (based on an average of Moody's, S&P, and Fitch

foreign currency long term sovereign debt ratings). Each security must have

greater than 1 year of remaining maturity, a fixed coupon schedule, and a

minimum amount outstanding of $100 million. Original issue zero coupon bonds,

"global" securities (debt issued simultaneously in the Eurobond and

US domestic bond markets), 144a securities and pay-in-kind securities,

including toggle notes, qualify for inclusion in the Index. Callable perpetual

securities qualify provided they are at least one year from the first call

date. Fixed-to-floating rate securities also qualify provided they are callable

within the fixed rate period and are at least one year from the last call prior

to the date the bond transitions from a fixed to a floating rate security.

DRD-eligible and defaulted securities are excluded from the Index.

ICE BofA Explains the

Construction Methodology of this series as:

Index constituents are capitalization-weighted based on their

current amount outstanding. With the exception of U.S.

mortgage pass-throughs and U.S. structured products (ABS, CMBS and CMOs),

accrued interest is calculated assuming next-day settlement. Accrued interest

for U.S. mortgage pass-through and U.S. structured products is calculated

assuming same-day settlement. Cash flows from bond payments that are received

during the month are retained in the index until the end of the month and then

are removed as part of the rebalancing. Cash does not earn any reinvestment

income while it is held in the Index. The Index is rebalanced on the last

calendar day of the month, based on information available up to and including

the third business day before the last business day of the month. Issues that

meet the qualifying criteria are included in the Index for the following month.

Issues that no longer meet the criteria during the course of

the month remain in the Index until the next month-end

rebalancing at which point they are removed from the Index.

..

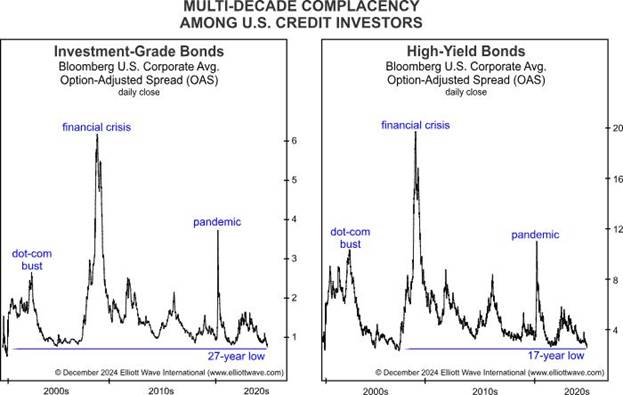

From Elliottwave International (EWI):

EWI's analysis suggests that credit spreads

tend to widen and narrow in a cyclical pattern with an approximate duration of

3.4 years. This implies that periods of increased risk aversion and widening

spreads are often followed by periods of increased risk appetite and narrowing

spreads which have been the rule since July 2022 when spreads started to

decrease.

Two of the most important credit-market sentiment indicators

in the United States point to extreme optimism. On November 8th,

investment-grade credit spreads (left chart below) narrowed to just 74 bps,

their tightest level in nearly three decades. One week later, high-yield (i.e.

junk) spreads fell to 253 bps, their tightest level in nearly two decades. The

equivalent spreads in Europe have narrowed to their tightest levels since early

2022:

As shown in the charts above, terrified

investors sold corporate bonds indiscriminately, driving up spreads, during the

zenith of the dot-com bust, great financial crisis/mortgage meltdown, and the

COVID 19 pandemic. EWI asks, Are credit

spreads preparing for another blowout?

If so, the prices of high-yield bonds, ETFs, and funds might decline by

over 25%.

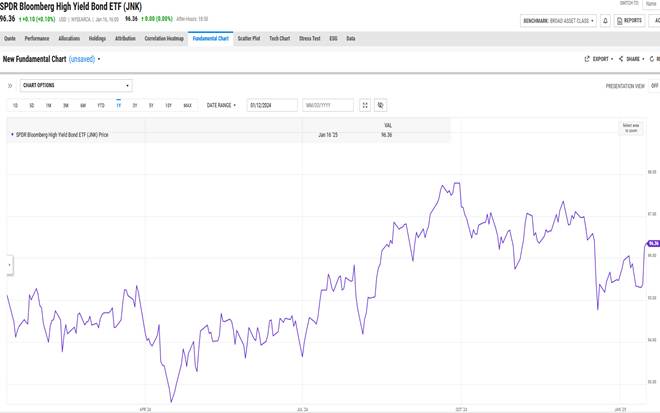

Heres a 1-year total return chart of JNK-

the most popular high yield bond ETF, courtesy of Y-Charts:

While JNKs price has popped this week, a

multi-year top was made in October 2024.

Credit spreads have been treading water since then, even with U.S.

Treasury yields rising.

To profit from a decline in junk bonds or

increase in high yield/Treasury credit spreads, one could short JNK or buy the ProShares

Short High Yield ETF (SJB). The Curmudgeon has bought and held SJB in his

portfolio for several years in anticipation a U.S. recession which has not

(yet) materialized.

Success, good health and good luck. Till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).