2024 Market Year in Review and Victors Tactical Outlook

By Victor

Sperandeo with the Curmudgeon

2024 Market Year in Review:

2024 was a great year for large cap tech stocks, with both the tech heavy NASDAQ 100 and the

market cap weighted S&P 500 each up ~ +25% total return. However, a lot of

those gains were concentrated in the most popular stocks. Please refer to the top nine S&P 500

stocks, by market cap weighting, in this Table:

Symbol

Company Market Cap ($B)

AAPL Apple

Inc. 3,561.72

NVDA NVIDIA Corporation 3,328.44

MSFT Microsoft

Corporation 3,114.84

GOOG Alphabet Inc. 2,357.02

GOOGL Alphabet Inc. 2,350.76

AMZN Amazon.com, Inc. 2,302.16

META Meta Platforms, Inc.

1,554.73

TSLA Tesla, Inc. 1,267.14

AVGO Broadcom Inc.

1,051.42

Note: Market cap id as of January 10, 2025

.

Overall, stock market returns were within the historical

average most everywhere else. For example, the Russell 2000 returned +11.54% in 2024 while the Dow Jones Industrial Average (DJI)

returned 13.3% last year.

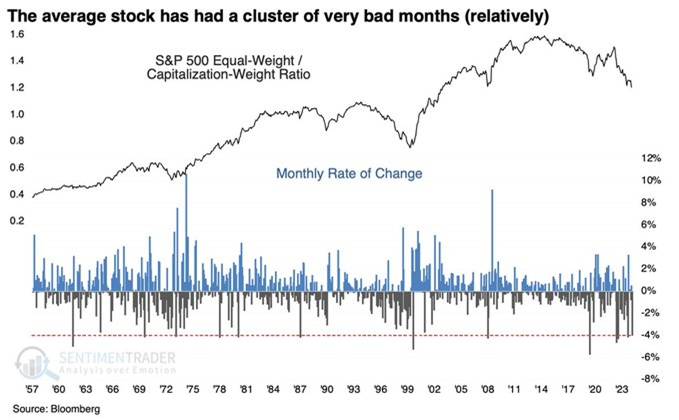

In December, the equal-cap

weighted S&P 500 trailed the popular capitalization-weighted version by

nearly 4%. That was one of the worst relative showings since 1957, according to

Bloomberg data and is shown in this chart:

In Other Markets:

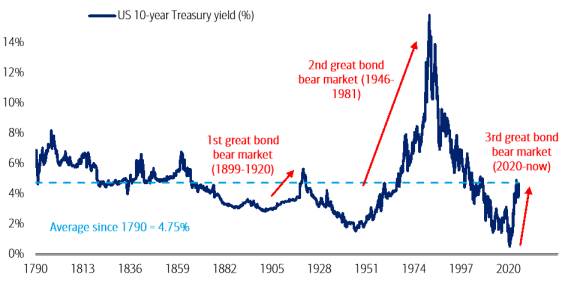

U.S. Government Bonds

and Notes had very poor years, as debt prices decreased (while

yields went up) across the board. This makes four years in a row that Treasury

Bond futures finished in negative territory, and it appears U.S. bonds are in a

great secular bear market. Kindly consider this chart, courtesy of BofA Global Research:

Gold had a tremendous year, with spot gold finishing up over +26%.

Commodities were up 12.5% using the CRB

Commodity Index, while Bitcoin

was up over +120%. Of course, Bitcoins standard deviation is more than ten

times higher than the NDX, and twelve times more than the S&P 500.

Generally, inflation-sensitive assets did the best: stocks,

gold, and Bitcoin. Real estate, which can also be inflation- sensitive, held

its own in 2024. The credit (and blame) for the performance of these assets was

mostly due to U.S. Federal Reserve monetary policy, and seemingly never-ending,

budget busting U.S. government spending. Those policies favored stocks and inflation

assets, and penalized debt prices. Higher Interest rates, especially after the

Feds ill-advised 50bps rate cut in September, hurt bonds, but did not slow

down the mega-cap high-tech sector, which is where money continues to flow.

IMHO, U.S. Government debt of ten years or longer in duration

is fundamentally not investable without a recession, due to the huge supply of

Treasury debt coming to the market. This is in turn due to the unprecedented

deficit spending (without a recession), and rolling

over of maturing debt.

As is common in an election year, the federal government spent

like never before during a period of sustained economic growth. The

annual deficit of 7.5% of GDP is unheard of during a growing economic

environment. This is not Keynesianism (as it was created to be), but rather an

extreme form of Statism [1.], which buys votes to maintain

power.

Note 1. Statism is a

political system in which the state has substantial centralized control over

social and economic affairs.

As Alexis De Tocqueville said in his book Discovering America: The American

Republic will endure until the day Congress discovers that it can bribe the

public with the public's money.

Victors Tactical Stock

Market Outlook:

U.S stocks have made a short-term top (short term is days to

weeks). The S&P made a high on 12/06/24 at 607.81, then made a minor low

12/19/24 at 586.10, and after a rally to 601.34 on 12/26/24, sold off and

closed BELOW the 12/19/24 low. This pattern has occurred across the board to

virtually all stock indexes and implies U.S. equity markets are in for an

intermediate (weeks to months) correction of 10% or more. Any forthcoming correction, with such

extremely high valuations, has a good possibility of being the first leg of a

bear market. Therefore, readers might

consider cutting equity exposure by 50%.

Curmudgeon Comments:

With great uncertainty due to geopolitical hotspots, Trumps

tariff and immigration policies, Federal Reserve now certain to hold off future

rate cuts for most if not all of 2025, we are astonished that stocks have not

sold off and that credit spreads (high yield vs U.S. bonds) are at multi-decade

lows. The average U.S. investment-grade

spread sat at just 0.83 percentage points on January 8th, not far

above its narrowest point since the late 1990s, according to ICE BOFA.

To take advantage of tight spreads, corporate borrowers

kicked off the first week of 2025 with a record $83B in bond sales.

There are a lot of risks to spreads inflation picking up,

the economy slowing down, the Fed potentially pausing rate cuts and even moving

on to rate hikes, said Maureen OConnor, global head of Wells Fargos

high-grade debt syndicate. Evidently,

the bond market is not too concerned about those risks, but it is pushing

yields on U.S. Treasury notes and bonds substantially higher. Thats a super conundrum to the Curmudgeon???

Euphoria Charts

(courtesy of Elliott Wave International):

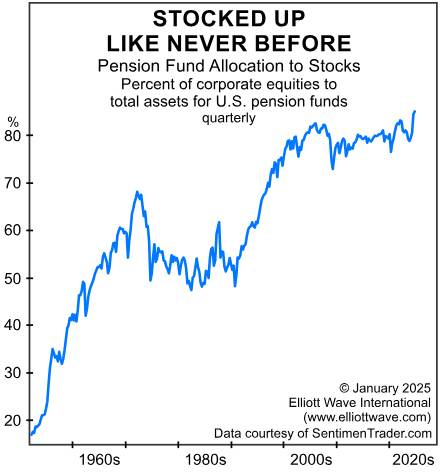

While pension fund stock allocation is at an all-time high, stock

market mutual fund cash (as a % of assets) recently reached an all-time low of

2.9%! And according to a recent Bank of America global fund manager survey,

cash as a percentage of total assets under management dropped to 3.9% in

December 2024. The only time fund managers cash allocations were near the

current levels was during January to March 2002 and in February 2011.

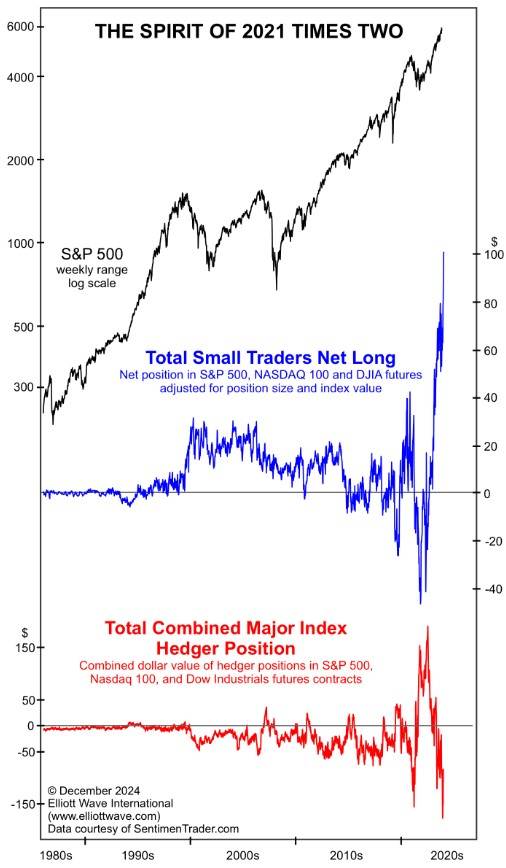

Meanwhile, small futures speculators have been loading up on

net long positions, while smart money hedgers have greatly reduced them. Thats show in this chart:

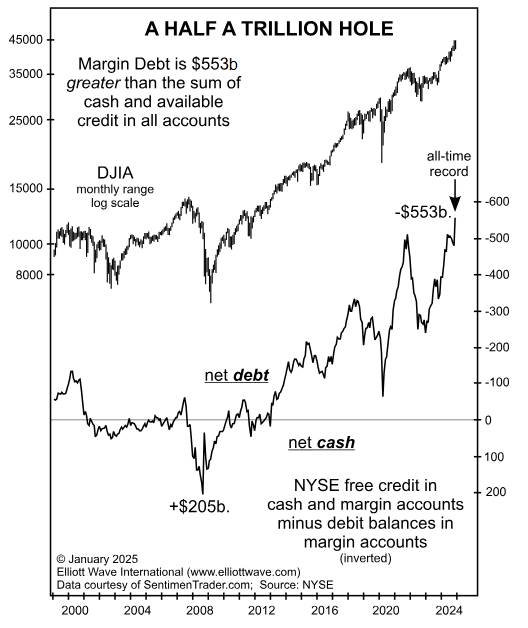

Finally, margin debt is $553B greater than cash and credit in

stock brokerage accounts as per this chart:

If stocks decline sharply, margin calls will be triggered,

which will exacerbate the decline and turn it into a rout! In the past month alone, leveraged long

assets relative to leveraged short assets have increased 258%. Historically, great stock market peaks have always

been backed by immense leverage. Till it ends

.

End Quote:

Instead of hoping he must fear and instead of fearing he

must hope. He must fear that his loss may develop into a much bigger loss, and

hope that his profit may become a big profit. Jesse Livermore

.

Victor and the

Curmudgeon wish our readers all the best in 2025. Please spread the word

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2025 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).