Huge Divergences between

Fed Funds, U.S. Notes/Bonds and Stocks

By the

Curmudgeon with Victor Sperandeo

Fed Funds vs U.S. T-Notes and

TLT:

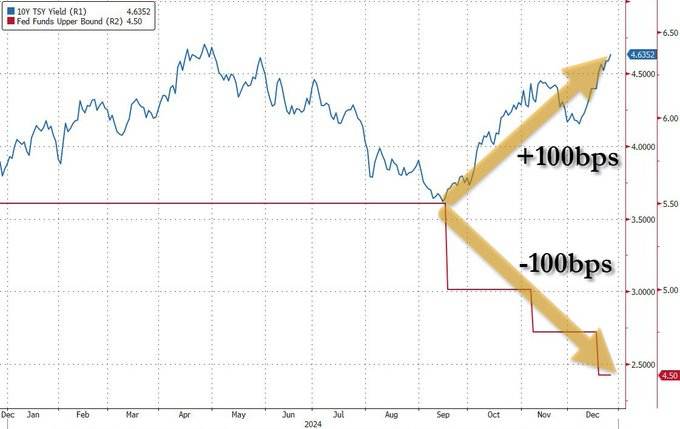

Today, Zero Hedge posted on X: This is the first time in

history when 100bps of rate cuts raised 10Y yields by 100bps, as per this

chart:

The divergence is even greater than that if you substitute

TLT (U.S. 20+ year bond ETF) for the 10-year T-Note:

Since Sept 17, 2024- One day before the Feds 50bps rate cut

- TLT was at 99.44, but it dropped to a low of 86.98 on Dec 24th. That's a loss

of 12.5% in a little more than two months!

Stock Market Valuation

at an Extreme:

While U.S. notes and bonds tanked since the Feds Sept 18th

50bps rate cut, the S&P 500 and NASDAQ soared to the most overvalued U.S.

stock market in history! Lets look at a

few measures of stock market valuation.

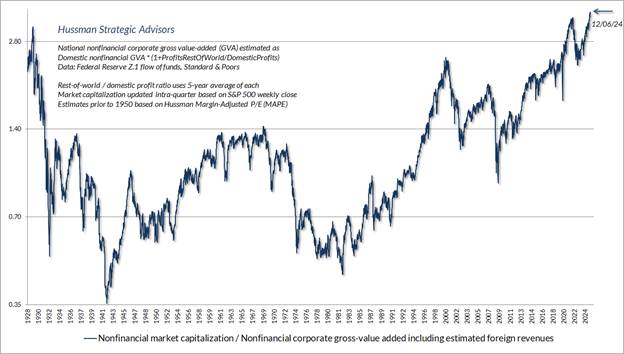

The chart below shows John

Hussmans most reliable gauge of market valuations in data since

1928: the ratio of nonfinancial market capitalization to gross value-added (MarketCap/GVA). Gross value-added is the sum of corporate

revenues generated incrementally at each stage of production, so MarketCap/GVA might be reasonably be viewed as an

economy-wide, apples-to-apples price/revenue multiple for U.S. nonfinancial

corporations.

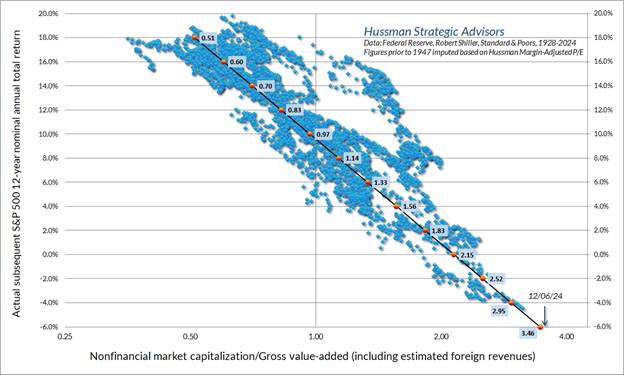

The chart below shows the relationship between MarketCap/GVA and actual

subsequent 12-year S&P 500 average annual total returns, in data since

1928.

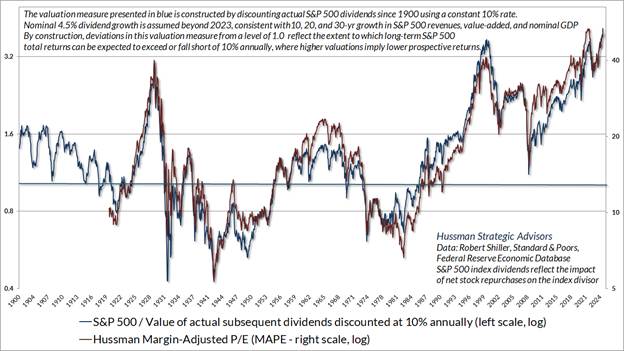

The next chart below shows Margin-Adjusted

P/E, which considers cyclical variations in profit margins and their impact

on the price/earnings ratio, along with the ratio of the S&P 500 to the

present value of actual subsequent S&P 500 dividends at every point in time

since 1900, discounted at a constant rate of 10% annually (see chart text for

additional details). The ratio therefore estimates the extent to which likely

long-term S&P 500 total returns are likely to depart from a 10% average

return. The higher the valuation, the larger the expected shortfall from

historically run-of-the-mill expected returns of 10%.

U.S. Stock Market Gains

Limited to Big Tech:

From Robert Prechters Dec 18th Elliott Wave Theorist

(subscription required):

While tech (stock) indexes get all the attention, the Dow

averages quietly stopped rising two and three weeks ago. The Dow Jones

Transportation Average in fact made its all-time intraday high three years ago,

on November 2, 2021, but it made an all-time daily closing high on November 25,

2024. On the same day, the Russell 2000 index made its all-time intraday and

daily closing highs, by a whisker above the highs of November 8, 2021. The Dow

Jones Utility and Composite Averages made their all-time closing highs on November

26 and their all-time intraday highs on November 27. The Dow Jones Industrial

Average peaked on December 4. Each average immediately entered a persistent

decline despite later new highs in the tech heavy indexes.

..

Authors Note:

The Dow Jones Industrial Average notched its longest daily

losing streak in 50 years when it fell for a tenth straight session on Dec 18th

closing at 42,326.87. Its been straight down since its Dec 4th

closing high of 45,014.04 with a Dec 26th close at 43,325.80 .

..

Fitting the markets selectivity, the daily advances vs.

declines have been flat to negative the first twelve trading days in December.

Down volume was higher than up volume on ten of those days. Peter Eliades of Stock Market Cycles alerted me to the

fact that the cumulative a-d line broke a 13-month uptrend line in early

December.

And so it goes

Victors Conclusions:

While I agree with all of the above,

I have one question about Fed policy. First, heres a quote from a deep thinker

from the 16th century:

I never met a man who

thought his thinking was faulty. by Michel de Montaigne, who was one of the

most significant philosophers of the French Renaissance. He is known for popularizing the essay as a literary genre and his work had

a direct influence on numerous Western writers. Montaignes massive volume Essais contains

some of the most influential essays ever written.

Now the Question: Fed Chairman Jerome Powell has stated several times during

FOMC meetings that the Fed is DATA DEPENDENT. Yet at their December 18th

meeting, the Fed lowered its dot plot [1.],

from four to two rate cuts in 2025.

Note 1. The Feds dot plot is a chart that records each Fed

officials projection for the Fed Funds rate the U.S. central banks key

short-term interest rate. At the Dec

2024 Fed meeting, 10 FOMC participants forecast Fed Funds ending 2025 at 3.75%

to 4%, three at 4% to 4.25%, also three at 3.5% to 3.75%. See Figure 2. Page 3. here.

..

No one knows what incoming U.S. President Donald Trumps

trade/tariff, federal government spending and tax policies will be for the next

year or if Congress will approve any or all of them. So how can the Fed now forecast there will be

only two 25bps cuts in 2025 without knowing what the economic data will be next

year?

ΰHow does that align with

being data dependent or is the Fed now a fortune teller that can predict the

future U.S. economy???

ΰHas Jerome Powell ever thought his thinking was

faulty (Montaigne quote)? Perhaps he should look at the first graph in this

article for a sanity check.

Closing Quotes:

This is the longest period of practically uninterrupted rise

in security prices in our history

The psychological illusion upon which it is

based, though not essentially new, has been stronger and more widespread than

has ever been the case in this country in the past. This illusion is summed up

in the phrase the new era. The phrase itself is not new. Every period of

speculation rediscovers it

During every preceding period of stock speculation

and subsequent collapse business conditions have been discussed in the same

unrealistic fashion as in recent years. There has been the same widespread idea

that in some miraculous way, endlessly elaborated but never actually defined,

the fundamental conditions and requirements of progress and prosperity have

changed, that old economic principles have been abrogated

that business

profits are destined to grow faster and without limit, and that the expansion

of credit can have no end.

Business Week,

November 2, 1929

.

There can be few fields of human endeavor in which history

counts for so little as in the world of finance. Past

experience, to the extent that it is part of memory at all, is dismissed

as the primitive refuge of those who do not have the insight to appreciate the

incredible wonders of the present. Only after the speculative collapse does the

truth emerge.

-John Kenneth Galbraith,

A Short History of Financial Euphoria, 1990

Wishing all our readers a wonderful Christmas season, joyous

Hanukkah and Happy New Year!

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).