Chinese Stimulus “Bazooka”

Blasts Stocks Higher as Gold Soars Above 2,600

By Victor

Sperandeo with the Curmudgeon

China’s Huge Stimulus Program Rockets Stock Prices:

“The Big Chinese

Bazooka” was the title of a blog post

by Alfonso Peeccatiello to describe a “bazooka”

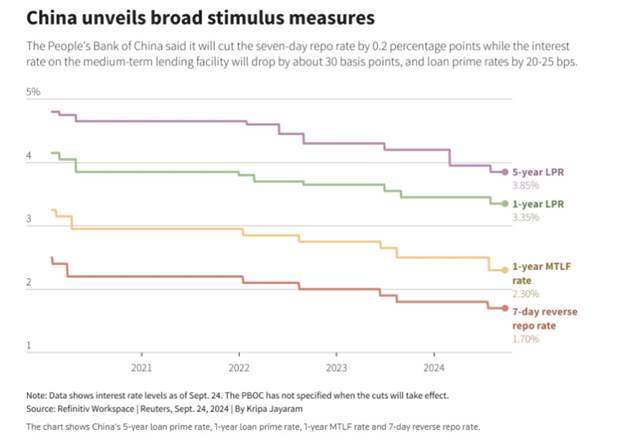

of stimulus measures China’s policy makers announced recently. The package included:

·

More interest

rate cuts.

·

The Chinese

version of the ''Fed put.''

·

Vague wording about fiscal stimulus.

Interest rate cuts and the ''backstop'' facility have

propelled the Chinese stock market, which was up

+21.43% in just 15 days (from 9/12/24-9/27/24)!

Here’s a 1-month chart of a CNYA – a popular ETF which tracks

China’s stock market as represented by "A-shares" that are accessible

through the Shanghai-Hong Kong Stock Connect program or the Shenzhen-Hong Kong

Stock Connect program.

………………………………………………………………………………………………………………………………………………………………..

Commodities are Bullish:

As China buys a great deal of commodities, it should

be no surprise that mostly all commodity futures markets are in uptrends

(except crude oil and natural gas). For example, Copper was up +15% since

September 4th, while Lumber was +11% in the last month, after making

a low on July 15th.

Also, the U.S. dollar has been weaker lately

against major foreign currencies which tends to push up the price of imports

and gives competing U.S. manufacturers an “umbrella” to raise prices.

--> That’s a telling sign that inflation could

come back with a vengeance, which may cause the Fed to pause the interest rate

cuts they have planned for later this year and next?

Side Comment: Victor

opines that West Texas Crude Oil futures are not rising because China buys most

of its energy from Russia at a discount. Also, there is arbitrage and switching

from crude oil/gasoline and diesel fuel to natural gas. That’s explained in a YouTube video questioning

the end of OPEC.

Stock Market Comments:

It seems unusual that Germany’s DAX stock

index made a new all-time high on Friday, while the German economy continues to

stagnate. Germany's real GDP declined by 0.2% in 2023 and is forecast to be

flat this year. The unemployment rate is expected to increase from 5.7% in 2023

to 6% in 2024.

-->That’s one of many global stock market

anomalies we have observed in recent years.

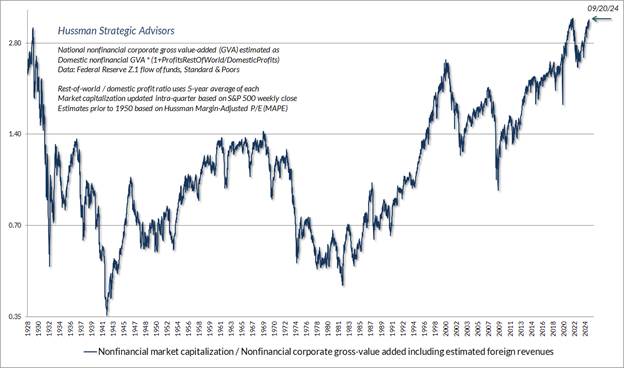

In the U.S., years of elevated stock market

valuations is yet another head scratcher as per this chart, courtesy of John

Hussman:

Even if one accepts analyst estimates of year-ahead S&P

500 operating earnings at face value, current valuations are at rare extremes.

Since the price/earnings ratio on forward operating earnings has only been

popular since the 1990’s, investors often overestimate both year

ahead earnings and what “normal” valuations (??) actually are.

The above chart shows super extended market

valuations since 1998, except for the 2008-2009 great recession/mortgage

meltdown.

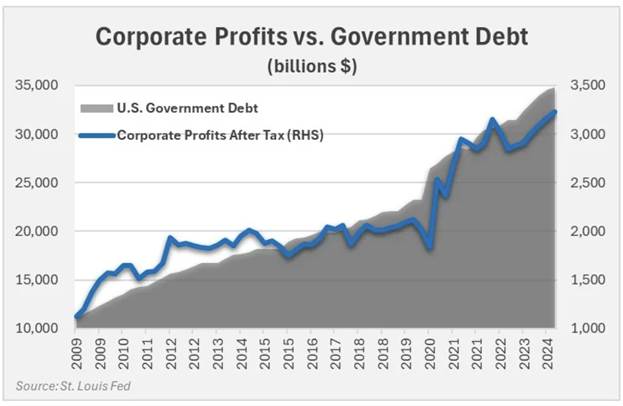

As we’ve noted in many past Curmudgeon/Sperandeo

posts, U.S. corporate earnings have increased mainly due to massive government

spending and deficits. More on this in the next subhead below.

For corroboration, Jesse

Felder wrote on X: “We believe corporate earnings have been inflated by

unsustainable growth in government debt and spending. History has been very

clear about profit and market cycles built on debt—they don't last.”

U.S. Budget Deficits and Stock Prices:

The S&P is now at an all-time high largely due to

humongous U.S. budget deficits. The

deficit was $380 Billion in August, which was $90 billion higher than

estimates. The total U.S. federal budget deficit should reach $2 trillion for

fiscal 2024. CBO forecasts it will grow to $2.8 trillion by 2034 (assuming no

recessions!).

-->Corporate America realizes a great deal of that

deficit as increased earnings which pushes up stock prices.

However, that was not always the case as we now

explain.

Curmudgeon Comments:

That budget deficits are now positive for stocks is

in sharp contrast to the 1980s when outsized budget deficits resulted in higher

yields on U.S. Treasuries. That created

a fear of corporate bond issuers being “crowded out” and therefore not being

able to borrow.

Stock prices made little progress during those years

as they were competing with high real yields on fixed income investments,

especially U.S. notes and bonds.

Here’s a table showing U.S. budget deficits, debt

increase and deficit-to-GDP-ration from 1980-1986:

|

1980 |

$74 |

$81 |

2.6% |

|

1981 |

$79 |

$90 |

2.5% |

|

1982 |

$128 |

$144 |

3.8% |

|

1983 |

$208 |

$235 |

5.7% |

|

1984 |

$185 |

$195 |

4.6% |

|

1985 |

$212 |

$251 |

4.9% |

|

1986 |

$221 |

$302 |

4.8% |

Stock prices went up and down during the early 1980s, but made little overall

progress as shown by this table of the S&P 500 prices by year:

|

Jan

1, 1985 |

171.60 |

|

Jan

1, 1984 |

166.40 |

|

Jan

1, 1983 |

144.30 |

|

Jan

1, 1982 |

117.30 |

|

Jan

1, 1981 |

133.00 |

And what about 1987 – the year of the largest one-day U.S. stock market

crash in history?

The U.S. budget deficit for the fiscal year 1987

was $149.8 billion, or 3.3% of GDP.

Unknown to most readers, the S&P did NOT bottom on October

19, 1987, after the “Black Monday” stock market crash that day, but at a split

adjusted close of 223.92 on December 4, 1987.

-->In fact, the S&P 500 lost -13.34% between

October 21, 1987, and December 4, 1987!

Victor’s Conclusions:

We have repeatedly stressed that political

uncertainty is the reason to be flat stocks and long gold as the

asset of choice to own now. In particular, geopolitical

risks and potential chaos in the November U.S. elections (and after).

-->Gold hedges both these events and so is

the way to stay solvent.

End Quotes:

“Civilization is like a thin layer of ice upon a deep

ocean of chaos and darkness.” Werner Herzog.

“Civilization begins with order, grows with liberty

and dies with chaos,” Will Durant.

…………………………………………………………………………………….

Be well, stay calm, success and good luck. Till next

time………...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).