Reliable Market Valuation

Gauge Tops Extremes of 1929 and 2000 Bubbles

By Victor

Sperandeo with the Curmudgeon

Democracy and Rule of Law at Risk in the U.S.:

“The Democratic Party has become "the

party of war, censorship, corruption, big pharma, big tech, big tech, big ag

and big money," said former Independent U.S. Presidential candidate Robert

F. Kennedy, Jr. That quote

basically says all you need to know about the Democratic party from one of the

former great family names of that party in the 1960’s.

Yet the Republican party is no better. They

want disruptive change, and if violence is necessary, so be it. Republican Charlie Dent voicing concern about

Trump’s inner circle, told GB News: “We'd see more of what we saw

before. Never-ending drama, chaos, disruption for disruption’s sake.

The president of the Heritage Foundation,

Kevin Roberts, recently said the U.S. is “in the process of the second American

Revolution, which will remain bloodless if the left allows it to

be.” It should be noted that the Heritage Foundation is America’s most powerful

and influential right-wing think tank.

However, the real threat to U.S. democracy is widespread

corruption in Congress and the Supreme Court. In an election purporting to be about the

survival of the “American Way of Life”, a miasma of transactional cash is the

real threat to democracy — one harming us all. David Sirota, recently wrote in Rolling Stone:

“In

just a few months, the U.S. Supreme Court’s billionaire–coddled justices made

it legal for politicians to accept gifts from beneficiaries of government

favors; Donald Trump promised to enrich fossil fuel industry donors in exchange

for $1 billion in campaign donations, while his running mate J.D. Vance begged

a tech billionaire to bankroll their campaign; moguls funneling cash to

Democrats demanded the firing of the antitrust regulator scrutinizing their

businesses; both parties held corporate–sponsored conventions that prominently

featured billionaires and CEOs as keynote speakers; and spending by Super PACs

and other shadowy groups crossed the $1 billion mark.”

U.S. Elections - Uncertainty and Distrust?

The November U.S. election results are impossible to

speculate on and “uncertainty” is a far too mild characterization.

Better to use the concept “distrust,” which could lead to violence.

Worse is that the main political parties may not

accept the election outcomes. A recent ABC News/Ipsos survey [1.]found differing opinions

about each Presidential candidate’s willingness to accept the results.

·

Just 29% of respondents think

Trump is prepared to accept the outcome while 67% say he’s unprepared to do so.

·

68% of respondents think

Harris is prepared to accept the results of the election while 29% say she is

unprepared.

·

81% say they are ready to

accept the outcome of the election while 17% say they are unprepared.

Note 1. This survey

was conducted Aug. 23-27 among 2,496 adults. It has a margin of error of 2

percentage points.

On August 30th, Myra Adam wrote in The Hill:

“If

Trump loses, expect a 2020 post-election replay with much ranting, raving and

contrived evidence. Team Trump will launch accusations of a corrupt, stolen

election, cheating, judicial weaponization, illegal voters, foreign

interference and rigged voting machines, resulting in legal challenges perhaps

all the way to the Supreme Court.”

Sidebar -International Tensions Abound:

Victor thinks the UK may be in worse shape than the

U.S. while the Euro-zone is on the cusp of falling into recession or

depression and/or war.

Also, the possibility of China invading Taiwan to

reclaim it as an integral part of the mainland is a huge geopolitical risk. And

the ongoing wars in Ukraine and the Middle East, which continue to

escalate.

On Saturday, Israel recovered the bodies of six hostages

(including American Hersh Goldberg-Polin) which had been killed by their Hamas

captors in Gaza. An Israeli official told Bloomberg News their remains bore

signs of execution by shooting. American-Israeli Joel

Chasnoff corroborated that during his Sunday “Inside

Israel” podcast.

The killings prompted Histradut

- the country’s largest labor union - to call for a strike to pressure Prime

Minister Benjamin Netanyahu to make a deal with Hamas for a cease-fire. All public institutions, including Ben Gurion

international airport in Tel Aviv, will be closed on Monday.

The slain hostages were mourned in the U.S., where President

Biden voiced outrage at Hamas and promised, in a statement, to keep “working

around the clock for a deal to secure the release of the remaining

hostages.”

-->Don’t hold your breath for that to happen!

“Those who murder hostages do not want a deal,” Netanyahu

said in a statement.

U.S. Economy is in “Never Never

Land:”

The best economist to follow at this time is the

pre-eminent Lacy Hunt, PhD, whose

views are recapped in a new interview

with “Thoughtful Money.” Among other worry signs, Lacy says that

Americans have a negative savings rate, while both Presidential candidates

fiscal proposals will significantly increase U.S. budget deficits and the

national debt.

Hunt also noted that consumer confidence and full-time

employment have been declining, firms are reducing the number of hours in the

workweek and the BLS overstated new jobs created by 818,000 this year.

All this evidence suggests the U.S. economy is much

weaker than most analysts believe and that flawed BLS job reports can’t be

trusted.

Hence, the U.S. economy is in “Never Never Land” as we can’t assess where it really is now

or where it’s headed.

For example, we have pointed out many times how the

Birth Death Model (BDM) and the BLS seasonal adjustments have distorted

economic activity. This has now blossomed into an unknown abyss.

Market Comments:

The U.S. equity markets topped several months ago,

with the S&P 500 making a high on July 16th and the NDX 100 on

July 10th. Last week, the Dow Jones Industrial Average and the

Invesco Exchange Traded TR S&P 500 Equal Weighted ETF (RSP) made all time

new highs.

YTD Graph of the RSP:

Victor suggests the end of the month of August marked a great

deal of window dressing (to make stock market portfolios more appealing to

investors). He has recently stressed

that it’s time to be on the sidelines, holding only gold and T-bills.

Chart of the Week:

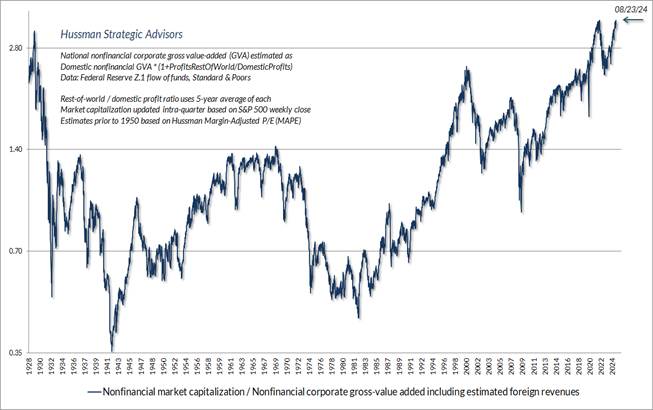

Shown below is John Hussman’s most reliable gauge of

market valuation, based on its correlation with actual subsequent 10–12-year

S&P 500 total returns in market cycles across all of history. MarketCap/GVA is the ratio of market

capitalization of U.S. nonfinancial companies to their gross-valued added,

including our estimate of foreign revenues. The current level exceeds both the

1929 and 2000 market extremes.

Chart Courtesy of Hussman Strategic Advisors

Hussman explains, “Clearly, more than a decade of

zero-interest monetary policy, coupled with the recent exuberance surrounding

mega-cap technology stocks, has deferred the full-cycle consequences of extreme

valuations. Still, the deferral of consequences is not the same as the absence

of consequences.”

………………………………………………………………………………………………….

End Quote:

Perhaps this quote will make clarify the notion of

risk:

“People are supposed to fear the unknown, but

ignorance is bliss when knowledge is so damn frightening.” — Laurell K.

Hamilton, in The Laughing Corpse. She is an American fantasy and romance writer

who has authored over 40 novels.

………………………………………………………………………………………….

Be well, stay calm, success and good luck. Till next time….

The

Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).