Is it Too Late for the

Fed to Overcome the Sahm Rule and Prevent a Recession?

By the

Curmudgeon with Victor Sperandeo

Stocks Rally on Lower Unemployment Claims - Really?

After a huge sell-off on Monday, triggered by a reversal of the Yen carry trade,

U.S. stocks bounced back later in the week.

Stock indexes rallied strongly on Thursday, August 8th (e.g.

S&P 500 + 2.3%, Nasdaq +2.9%, NDX 100 +3.06%). It was the best day for the S&P 500 and

Nasdaq since Nov. 30, 2022.

The rally was supposedly due to lower reported “unemployment

claims” the same day:

“Initial unemployment

benefits totaled 233,000 for the week ending Aug. 2nd, down from the upwardly

revised 250,000 the previous week, according to data released

Thursday. This figure fell short of the

240,000 weekly claims forecast by Trading Economics consensus data.”

Pundits say this week’s lower unemployment claims negated the

August 2nd BLS jobs report revealing a 4.3% unemployment rate. The latter number triggered the Sahm rule,

which forecasts a U.S. recession (with 100% accuracy since World War

II).

The Sahm Rule says that when the unemployment rate

has risen 0.5% from its 12-month low, a recession follows. Currently, it’s +0.8% from its 12-month low

of 3.5% in July 2023. We discussed this

rule under the subhead “U.S. Economy and the Fed” in this post.

In reality, the lower

unemployment claims number is meaningless as it has little or nothing to do

with corporate earnings, which are the main driver of stock prices.

For example, big tech companies have reported increased

earnings while layoffs continue to increase. Over 126,000 employees have been

laid off across 393 tech companies since the start of 2024, according to data

from tracking website Layoffs.fyi.

Also, equity markets didn’t tank when claims were rising

strongly for the last few months, while the unemployment rate was also

increasing.

U.S. Equity Markets Are Overdue for a 10%+ Correction:

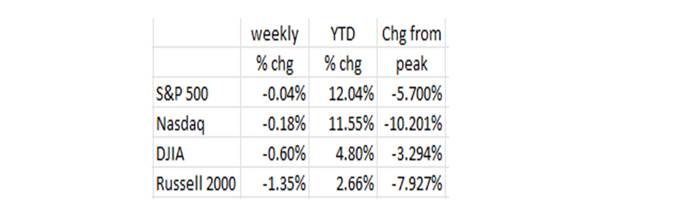

The S&P 500 has declined 6% from its July 16 high, the

NASDAQ is down over 10% and the Russell 2000 is ~-8%.

Yet pullbacks of this magnitude are not unusual. In recent years, 5%+ stock market declines

have occurred an average of three times per year, with 10%+ corrections

occurring once on average. [In the 1970’s, there were usually two 10%+

corrections per year.] 20%+ declines

(often referred to as “bear markets”) have occurred once every 3-to-4 years on average. These stock market declines by year are

depicted in the charts below, courtesy of BofA Global Research:

...………….…………..……….…………….……………………..…………..………….…………..

Will a Bear Market (20%+ Decline) Follow?

Most of the key market indexes are now below their respective

50 day moving averages that have leveled off and are heading down. Six of the Magnificent

7 (the 2023-2024 market leaders) declined this past week. Valuations

continue to be at record highs but have been elevated for many years.

These are all warning signs of a steeper decline in stock

prices in the near future. However, we don’t know yet if a bear market

will follow this year or next. The “buy the dip” mentality has been

ingrained in the equity markets since March 2009. Thus far, your authors have

to officially consider the current decline from the July highs a

correction in a bull market, which is the last confirmed primary trend.

BofA’s Savita

Subramanian believes that a bear market correction of 20%+ is unlikely, noting

that just 50% of the signposts that historically preceded S&P 500 peaks

have been triggered. That said, BofA’s S&P target

of 5,400 remains intact, offering only 1% upside from today’s price. Savita

says that “growth in the Magnificent 7 has slowed while it’s accelerating for

the other 493 stocks in the S&P 500, balancing the index. Volatility should

continue, as it tends to in the months ahead of a Presidential election.” He

believes the best volatility hedge is to own high-quality stocks with dividend

stability.

The Fed is Behind the Curve as U.S. Economy Weakens:

The Fed is bidding it’s time to lower rates and did not panic

last Monday after the global market sell-off.

However, every day the economy is weakening and so there will be

a price to pay for the Fed’s “higher for longer” interest rates regime,

especially since inflation has decreased.

On Thursday, August 8th, a NY Times article titled, “Recession Risks Rise as Consumers Turn Cautious.”

noted that consumer spending (which makes up ~70% of GDP) is declining

everywhere. Also, the number of people

working part-time who would have preferred full-time employment increased,

while the number of hours worked per week ticked down. Those indicate that

workers are taking home less pay and have so have less money to spend. Should

that trend continue, it could set off a damaging economic cycle whose impact

would be more widespread.

“The key risk at the moment is that firms begin to pull back

on hiring and that we see that translate into job loss,” said Michael Pearce,

the deputy chief U.S. economist at Oxford Economics. That could precipitate

even more restricted consumer spending, which could in turn lead to revenue

declines that could drive companies to cut jobs. “It’s this self-fulfilling

process,” Pearce added.

Inflation is Trending Down:

Over the past three months, core CPI and core PCE inflation

have seen monthly changes that are trending down towards the Fed’s 2% annual

inflation benchmark.

Consumers have become more price conscious and are seeking

out cheaper alternative products. The reluctance

of consumers to keep paying more has forced companies to slow their price

increases — or even to cut them.

Importantly, forward-looking indicators like company surveys

on hiring, business activity and pricing power, along with signals from the

commodity markets, indicate this downward inflation trend will persist.

On Monday, August 12th the N.Y. Fed’s July 2024 Survey of Consumer

Expectations revealed that inflation expectations were

stable at the short- and longer-term horizons, but fell sharply at the medium-term

horizon to a new series low. Median three-year-ahead inflation expectations

declined sharply by 0.6% to 2.3%, hitting a series low since the survey’s

inception in June 2013!

“Lower rates are justified by inflation pressures coming

down,” says Ed Yardeni, president of Yardeni Research.

This Wednesday, the BLS will release the consumer price index

(CPI) for July. It’s expected to show that core prices — excluding

volatile food and energy costs — rose just 3.2% from a year earlier. That would

be down from 3.3% in June and would be the lowest such year-over-year core CPI

rate change since April 2021.

Conclusions:

Skeptics (like the Curmudgeon) have begun to question whether

investors myopic focus on Artificial Intelligence (AI) will deliver on

the promise implied by the near-vertical rise of the market’s largest tech

stocks this year. Also, will this year’s uptrend broaden out to other (non

tech) stocks? And was the epic rally in small caps (i.e. Russell 2000) the

start of a sustained uptrend or a counter-trend bounce?

Investors are faced with a very contentious U.S. election in

November and heightened geopolitical risks (especially in the Middle East).

That could pose more worries for the markets than the Fed. These are very uncertain times for the

markets and the economy!

End Quote:

The operative word today is patience, as per this

quote from Napoleon Hill (author of the bestselling book Think and Grow Rich):

"Patience, persistence and perspiration make an

unbeatable combination for success."

………………………………………………………………………………………………………

Be well, success and good luck. Till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).