The Fed Flops Again and Markets React!

By Victor

Sperandeo with the Curmudgeon

Market Week in Review:

At the conclusion of the July 30-31st FOMC

meeting, the Fed left its benchmark rate unchanged at 5.25-5.50%, as widely

expected.

As per last week’s post, Victor thought the Fed

would cut rates at the conclusion of its July 31st meeting. Why?

The U.S. economy has been declining for months (except for government

spending and hiring) and inflation has markedly decreased.

We also forecast that Friday’s BLS employment report for

July (both the unemployment rate and non-farm payroll jobs added) would be much

weaker than the consensus expected. That out of the box call was right on

the mark!

Importantly, the markets, rather than the Fed, effectively

cut rates after the BLS payroll numbers were reported on Friday, August 2nd.

Interest rates dropped like a rock across the yield curve, while the equity

markets sold off by about 2%, with some big tech stocks declining much more

(AMZN -8.79%, INTC -26%, TSLA -4.24%).

Victor believes the stock market decline, which started

Thursday, August 1st could turn into a bear

market. However, that call needs far

more confirmation to be a fait accompli.

Furthermore, he believes a recession has begun, but that also

needs much more confirmation.

Warren Buffet seems to

agree with Victor. Berkshire Hathaway’s cash holdings jumped from $189

billion in the first quarter 2024 to a record $276.9 billion in the three

months ending on June 30th. Berkshire sold a net $75.5 billion of

stocks in the quarter, including about half its stake of Apple shares.

Berkshire has also been spending less cash to buy back its own stock,

repurchasing just $345 million in the second quarter.

Gold held up well last week

while U.S. bonds and T-Notes did very well indeed. In particular:

- The 30-year U.S.

bond yield (^TYX) fell from 4.429% on July 30th to close at

4.109% on August 2nd.

- The 2-year T-Note

yield is now at its lowest in 15 months and plummeting in a way that

suggests traders think the economy is slowing down for real.

- The 5-year T-Note

yield also declined and Victor sold his 5-year T-Note position at the

close on August 1st for a very nice profit.

This chart shows U.S. Treasury yields dropping like a rock

since July:

The Fed Fails Yet Again:

Your authors believe that leaving interest rates unchanged on

July 31st was a very unwise decision. As a result, the Fed is again behind the

curve of interest rates, the markets, and the economy with the U.S.

elections only three months away.

“Friday’s jobs report was the first clear sign of employment

slowing across virtually every metric,” said Rick Rieder, BlackRock’s

chief investment officer of global fixed income. “The Fed-funds rate is clearly

too restrictive relative to inflation that is trending in the low-2s with slack

building in the labor force.”

Evidently, the Fed was focused on its inflation battle, which

should have ended in June. They use price indexes (e.g. the PCE) that

are very poorly constructed, which results in very bad decisions on rates.

Obviously, their “higher for longer” rate policy was a huge mistake.

For many years, we have opined that “the Fed will never

get it right” with respect to its monetary policy. Their economic views and theories are

completely invalid, which leads to incorrect economic outcomes. One might

conclude that the Fed’s poor decisions are for political expedience or a

“hidden agenda,” which does not improve the standard of living of American

people.

While Victor has for years stated the Fed is beholden to

political interests with many Dems on its payroll. Yet during a press conference that followed

the FOMC meeting on Wednesday, Fed Chairman Jerome Powell strongly denied that.

He said:

"We don't change

anything in our approach to address other factors like

the political calendar. I'll say

this too: We never use our tools to support or oppose a political party, a

politician or any political outcome."

This is a super rationalization!

Unlike the ultra-responsible Paul Volker (Fed Chair from

August 1979 to August 1987), Powell never criticized the current

administration’s fiscal policy that has greatly increased inflation (one

of the two Fed mandates). Tremendous budget busting government spending, which

together with Fed “money printing” (aka “keystroke entries”), ballooned the

money supply. Indeed, the Powell-led Fed’s most glaring failure is that they

have ignored money supply growth when formulating monetary policy.

Over the years, we have many, many times quoted Milton

Friedman’s dictum which states: “Inflation is always and everywhere a

monetary phenomenon.”

Inflation has never occurred

without an increase in the money supply, with a lag of approximately

18-to-24 months. It’s the expansion of money and credit above production

and output that results in RISING PRICES, aka inflation.

In the U.S., the inflation culprit has been massive government

deficit spending, the money for which was “printed” by the Fed and

its member banks. For example, the rate of growth in the money supply soared

after COVID-19 due to massive government stimulus/handouts and Fed debt

monetization. That peaked in April 2021, at a pace over four times more rapid

than pre-COVID money supply growth. Nineteen months later, the U.S. inflation

rate peaked at 9.1% and was also over four times higher than its pre-COVID

rate.

The Stagflation U.S. Economy is Now Weakening:

The U.S.

economy has experienced stagflation in the last 4 1/4 years (ending March 2024)

with more price increases than growth. For example, gross GDP in the 4th

quarter of 2019 was $21,902.4 Trillion (T) with real GDP at $20,951.1 T. Compare that to the latest quarter (Q1) in

2024 where gross GDP was $28,269.2 T with real GDP at $22,758.8 T.

-->Gross

GDP grew at 6.18% annually, but real GDP grew at only a 1.97% rate, with the

obvious difference being price increases.

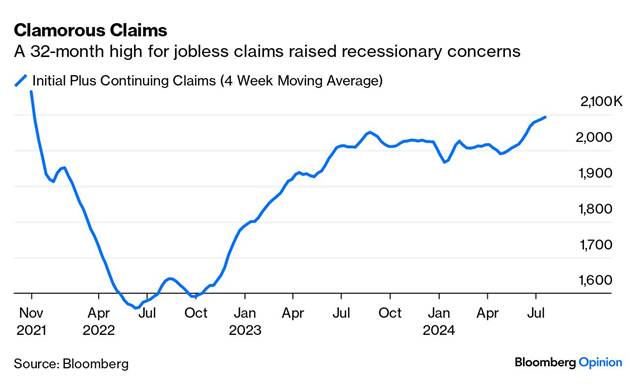

We’ve been

“pounding the table” for weeks that the U.S. economy was much weaker than

analysts assumed. In addition to the

very weak BLS employment report on Friday, jobless claims and continuing

claims (which are reported every two weeks) are on a clear rising trend and

the highest since late 2021 as per this chart:

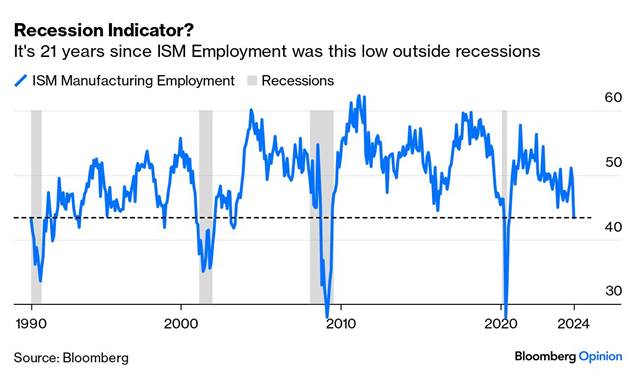

Meanwhile, the monthly ISM survey of supply managers in

the manufacturing sector was horrible. Economic activity in the

manufacturing sector contracted in July for the fourth consecutive month and

the 20th time in the last 21 months, according to the nation's supply

executives in the latest Manufacturing ISM Report On Business®.

Notably, the

diffusion index on manufacturers’ plans for employment is at its lowest

since the beginning of the COVID pandemic in March 2020.

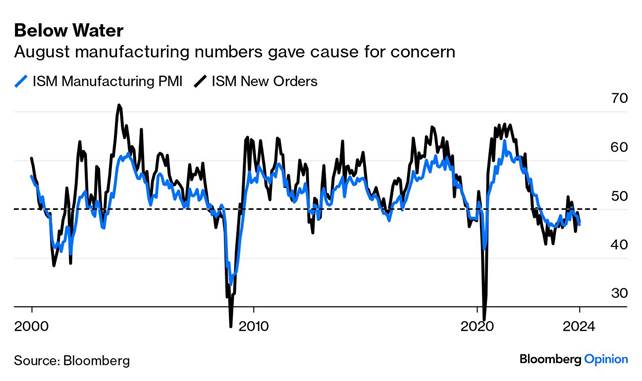

The headline manufacturing PMI and the new orders

reading (which is a good leading indicator), both slipped ominously into

negative territory. In theory, any number below 50 means recession rather than

contraction.

Are BLS Employment Reports Accurate?

That’s a rhetorical question! The BLS shows non-seasonally adjusted jobs at +1,239,000 for

the first seven months of 2024), but adds 908,000

“estimated” jobs via the Birth Death Model (BDM).

We have discussed the phony BDM estimate many times in the

last 10 years, but it seems very few are paying attention.

The upshot is that real counted new jobs were +331,000 jobs

or +47,300 jobs per month in 2024 to date! Most economists think its +177,000 per month as they ignore BLS’s addition of the

BDM.

To say the jobs market is strong is fooling yourself.

Bankruptcies are the highest since 2008, but the BDM says new businesses are booming?

Commodity Markets Decline:

Commodity prices have fallen greatly from the highs of this year,

which reflects a weak economy and a decline in money supply. After a big advance through May, the

Bloomberg Commodity index (DJP) is now down -1.06% YTD. That’s illustrated in the bottom panel of the

chart below. The top panel is the DJP/Vanguard Total Stock Market ETF.

Chart courtesy of https://stockcharts.com/sc3/ui/?s=DJP

Victor’s proprietary DTI Long/short Commodity index (branded

by S&P from 2004-2022) shows which commodities/currencies/US debt are in

uptrends or downtrends. Its current status is as follows:

- Short Aussie and

Canadian dollar

- Short U.S. dollar

- Short grains

- Short meats

- Flat oil complex

- Short copper

- Short natural gas

- Short sugar and

cotton

- Long U.S. Bonds

and Notes

- Long Euro, Yen,

Pound

- Long Gold and

Silver

- Long Coffee and

Cocoa

Victor’s Conclusions:

Expect the Fed and its proxies to start their “talk the

talk” about a 50bps rate cut at its September FOMC meeting. Financial markets have already priced that

in. The CME Fed Watch tool now forecasts an 80%

probability of Fed Funds at 4.75% to 5%

at the conclusion of the September FOMC meeting!

On Friday, the six month T-bill

yield was 4.88% vs. the current 5.37% Fed Funds rate. One-year T-bills are yielding 4.33%, which is another discounting guide of

where interest rates are headed.

The yield curve is currently only 8 bps inverted and is

poised to un-invert very soon. A recession has always started after the yield

curve normalized as we noted last week.

-->It seems Fed Chairman Jerome Powell is catching up to

Donald Trump as the most disliked politician in DC.

Massachusetts Senator Elizabeth Warren, one of the

Fed’s loudest critics, tweeted: “Fed Chair Powell made a serious

mistake not cutting interest rates. He’s been warned over and

over again that waiting too long risks driving the economy into a ditch.

The jobs data is flashing red. Powell needs to cancel his summer vacation and

cut rates now — not wait 6 weeks...” We

agree, that’s absolutely correct!

Closing Quote:

“The most dangerous man to any government is the man who is able to think things out for himself, without regard to

the prevailing superstitions and taboos. Almost inevitably he comes to the conclusion that the government he lives under

is dishonest, insane and intolerable, and so, if he is romantic, he tries to

change it. And even if he is not romantic personally

he is very apt to spread discontent among those who are.” ― H.L. Mencken, Prejudices:

Third Series

End Note:

You won’t find our incisive analysis in the MSM or anywhere

else!

…………………………………………………………………………………………….

Be well, success and good luck. Till next time…………..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).