A Super Shocker from the July 25-27th Bitcoin

Conference!

By Victor

Sperandeo with the Curmudgeon

Introduction:

Two Presidential candidates spoke at the July 25-27th

Bitcoin Conference in Nashville Tennessee. RFK Jr. made a keynote speech on

Friday, while Donald Trump was onstage Saturday. We summarize those

talks with our incisive analysis of RFK Jr’s ultra shocking speech.

Then we examine the week ahead for the markets, the Fed vs

the U.S. economy and Victor’s market positions plus his Conclusions.

RFK’s Keynote Speech:

In our opinion, RFK Jr’s keynote

speech was the “PINNACLE of PANDERING” of the masses in the

history on the world. His vision for integrating Bitcoin into America's

economic and national security strategies is disconcerting, chilling, and

alarming.

As an independent presidential candidate, RFK Jr. proposed

incredibly bold initiatives including making the U.S. government a major

Bitcoin buyer [1.], eliminating taxes on Bitcoin transactions, and using

Bitcoin mining as a strategic U.S. asset to fund various government programs

such as green energy.

Note 1. RFK Jr’s

day one Executive Order, would require the U.S. Treasury to

purchase 550 bitcoins a day till they buy four million and own ~ 20% of the

worldwide Bitcoin market. Obviously, the

government would have to use fiat money to buy them, which would astronomically

increase the U.S. budget deficit, national debt and debt service costs!

“I’m going to support making direct ownership of bitcoin

tax-free,” Kennedy Jr. said. “The conversion of Bitcoin back into dollars will

be a non-reportable transaction to the IRS and not subject to capital gains,”

he added. That would make Bitcoin a

better investment/speculation than Muni Bonds for which capital gains are

taxed!

-->This idea has no legal bases and is 100%

unconstitutional.

Kennedy Jr. said he would consider two strong Bitcoin

advocates for U.S. Treasury Secretary - MicroStrategy Chairman/Founder Michael

J. Saylor or Custodia Bank CEO and Founder Caitlin Long – if he was elected

President in November (now more unlikely than ever).

-->We suggest readers watch/listen to Michael Saylor’s

speech. He is perhaps the largest bitcoin holder to date, who is

calling for Bitcoin to go into the trillions by 2045?

Trump’s Keynote Speech:

Donald Trump stopped short of promising to establish an

official U.S. Bitcoin strategic reserve currency during his keynote speech at

the 2024 Bitcoin Conference. Instead, he pledged to maintain the current level

of bitcoin holdings that the U.S. already has amassed (which was obtained from

seized assets of financial criminals).

Trump’s pitch was notably less radical than RFK Jr.’s

proposal of building a four million bitcoin strategic reserve to match the

government’s current stake in Gold.

Trump said that Bitcoin’s total value is now bigger than the market cap

of Exxon-Mobil, would soon surpass the global value of

Silver, and might surpass all the world’s Gold holdings.

Trump said that he was addressing a high IQ Bitcoin

community but was running against a low IQ opponent (i.e. Kamala

Harris who he later called a “radical left lunatic.”).

Trump promised to “make the U.S. the Crypto (currency)

capital of the planet and the Bitcoin superpower of the world and we

will get it done… Bitcoin will be mined, minted and made in the U.S. and

nowhere else.” He added that he is the

first Presidential candidate to accept donations in Crypto and Bitcoin and he’s

received a lot of those!

Here’s a chart of Bitcoin’s meteoric rise this

year (+136.64%). It has outpaced all other asset classes by far!

Sperandeo/Curmudgeon Analysis and Opinion (UGGH!!!):

RFK’s keynote was so disturbing for the Curmudgeon, that he

had to stop watching the speech midway through it. Victor had more endurance

and watched the entire speech on You Tube.

Your authors very much liked RFK Jr’s ideas and were

seriously considering voting for him in November. That’s no longer the case!

-->It’s imperative that readers listen to what RFK Jr.

said to the 20,000 Bitcoin conference attendees if you were planning to vote

for him.

Evidently, RFK Jr. wants to entice Bitcoiner

votes for benefits that his new government would offer them if he were elected

U.S. President in November. He claims there are 60 million bitcoin holders, and

he wants all holders that are U.S. resident citizens to vote for him!

We think this is a form of tyranny which would use newly

printed fiat dollars -which have already been devalued- to buy Bitcoin, thereby

driving up its price. That would

increase the wealth of Bitcoin holders in exchange for power/votes.

-->The result would be a “mad max” economy with the whole

world buying bitcoin and selling everything else!

What a scam! It’s an absurd form of bribing voters. RFK

Jr’s ideas are not only crazy, but fantastically preposterous. If accepted, his

insanity could be more contagious than Covid-19!

RFK Jr losses our vote!

We don’t own Bitcoin but believe it should be legal

to trade at a free market price, if people want to buy or sell it.

→Based on his speech, if RFK Jr was elected U.S.

President in November, it would be the end of America as we know it.

The Week Ahead for the Markets:

After a tumultuous week for both U.S. politics and equity

markets, we head into next week with the Fed meeting on July 30-31st and the

BLS jobs report on August 2nd.

We’ll also get the S&P Case-Shiller home price index (20 cities),

Consumer Confidence report, Employment Cost Index and Pending Home Sales BEFORE

the Wednesday-Thursday FOMC meeting.

Going against the consensus, Victor expects the Fed to cut

the Fed Funds rate by 25bps on July 31st .

According to the CME Fed Watch Tool, there’s a 96%

probability of no rate cut, based on Fed Funds futures prices. If the Fed does not reduce the Fed Funds

rate, Victor expects an ~-10% decline in the S&P 500 to start almost

immediately.

[The Curmudgeon begs to differ as he believes the equity

market has not priced in a Fed Funds rate cut this coming Thursday.

Furthermore, six or seven Fed rate cuts were supposedly “baked in” to equity

prices at the beginning of this year, but the market has NOT sold off, even

though there hasn’t been a single rate cut yet in 2024.]

If there’s no rate cut on Thursday, Victor believes the stock

market action will look like Dec 19-24, 2018, after Fed Chairman Jerome Powell raised

rates 25 bps. The S&P sold off

for the next four trading days, bottoming on Dec 24th at 2351

(closing price) for a quick -8% loss. The Fed changed back to easing talk in

early January, and soon began easing. Victor opines that this is yet another

example where the Fed zigs when it should zag!

The Fed and the U.S. Economy:

Victor believes the unemployment rate for July will be 4.2%

when it is reported on Friday, August 2nd (vs 4.1% currently).

Non-farm payrolls will also be below the consensus forecast of 190,000 jobs

added (that number is always overstated in July due to faulty BLS seasonal

adjustments).

-->The

Fed will know those numbers by July 31st, which might give them

cover to cut rates when their decision is announced at 2pm EDT that day.

However, there’s a mixed hearing on whether Powell and his

cohorts should cut rates week from people I greatly respect (e.g. Bill Dudley

vs. Larry Summers). So, the July 31st Fed rate cut is only a

speculation.

The U.S. economy is declining very rapidly as we discussed in

last

week’s Curmudgeon post. Some non-discussed reasons:

·

Commodities, using the

Bloomberg Commodity Index (DJP), are now down for the year, after being up

almost 13%!

·

The yield curve is on the

verge of becoming normal again or un-inverting. That is a sign of recession

which has a 100% track record.

·

The one

year T-Bill yield has fallen from 5.09%, at the end of June to Friday’s

4.79% or -30bps.

·

The Truflation index

(see graph in last week’s post) hit another new low Friday while closing at

1.63% Saturday. Yet the last CPI reading is almost double that!

Victor’s Market Positions:

On July 1st, he sold the S&P 500 futures (long

liquidation- NOT a new short position) and bought the 5-year U.S.

T-Notes. For comparison:

·

The SPY ETF (S&P

500) was 545.34 on the July 1st close and was 544.38 on Friday July 26th

-so virtually flat this month.

·

The IEI ETF (iShares

3-7 Year Treasury Bond ETF) was 114.70 and the yield was 4.44% at the close on

July 1st. Currently the IEI

is at 116.18 and the yield is 4.06% - so he’s slightly ahead.

Victor’s Conclusions:

A chronic problem today is the U.S. Congress, which is being

bribed by special interests to sell out the people for money and power. The brilliant men who wrote the U.S.

Constitution knew of this danger, but the Constitution is being largely ignored

today by our lawmakers. Without

oversight of elected officials, we have tyranny by those in power who make up

loopholes to serve their special interests.

End Quote:

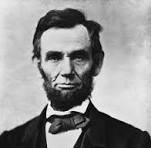

“I see in the near future a crisis approaching that unnerves

me and causes me to tremble for the safety of my country... corporations have

been enthroned and an era of corruption in high places will follow, and the

money power of the country will endeavor to prolong its reign by working upon

the prejudices of the people until all wealth is aggregated in a few hands and

the Republic is destroyed.” Abraham

Lincoln

Stay calm, wishing you success, good health and good

luck. Till next time……………….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).