The Markets and Economy vs. November U.S. Elections

By Victor

Sperandeo with the Curmudgeon

U.S. Elections Uncertainty Reigns Supreme:

The significance of the November U.S. elections cannot be

overstated. Politics under current conditions are of primary importance to the Fed,

U.S. economy and financial markets.

As expected,

U.S. President Joe Biden announced Sunday hes dropping out of the 2024

race and endorsed Vice President Kamala Harris to be the Democratic

partys new nominee. He wrote in a letter to fellow Americans that It is in

the best interest of my party and the country for me to stand down and to focus

solely on fulfilling my duties as President.

VP Harris vowed to earn and win the nomination, while Biden

said hed address the nation later this week in more detail.

Biden will now have to release his 3,896 pledged delegates,

but its not certain they will all pick Harris as their partys nominee for

President. There are an estimated 3,933

pledged delegates and 739 super-delegates, according to NBC.

There are no definitive rules for who will be chosen as the

Democratic Presidential nominee at the Dems August 19-22, 2024

convention. The Curmudgeon discussed

several scenarios in this post: Will Chaos at the GOP and

Democratic Conventions Disrupt Financial Markets?

One new suggestion is to have former U.S. Presidents Clinton

and Obama oversee debates with the top Democrats (about eight well known

politicians) and vote on a nominee.

However, theres no guarantee Bidens pledged delegates would accept

such a vote.

These are all questions that are going to be made up on the

fly by the Democratic leadership. Therefore, the outcome is totally unknown at this point in time. However, does it really matter?

Donald Trump is a very

heavy favorite to win the U.S. Presidency in November. According to BetMGM UK, Trump has a 55.80%

chance of winning compared to Harris 26.87%.

However, the elections for U.S. Congress are a big question

mark. The Senate is leaning towards the

GOP, while the House is a 50/50 toss-up.

If the Democrats win one of the two branches of Congress, Trumps agenda

means very little.

Now, lets focus on the markets

.

Is the Small-Cap Rally the Real Deal?

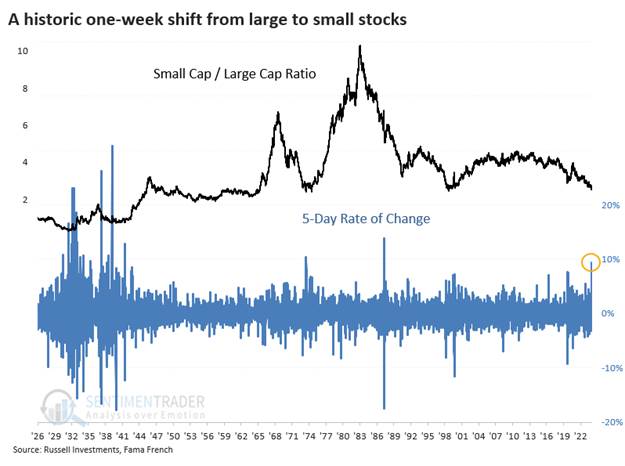

The small-cap Russell 2000 enjoyed a historic six day winning

streak of 1%+ gains each day with the index closing up

more than 3% on Wednesday, July 17th. That left the Russell 2000 (and the IWM ETF)

at an astonishing 4.42 standard deviations above its 50-day moving

average. Over five days, the ratio of

small-cap total return to large-cap total return jumped by nearly 10%. That's

one of the largest shifts in nearly 100 years!

Sentimentrader says that Federal Reserve easing cycles have generally

helped smaller stocks over larger ones, with peaks in the Fed Funds Rate

roughly coinciding with some crucial bottoms in the ratio of small caps to

large caps. As investors anticipate the next easing cycle, they have

kick-started this shift dramatically. The adjustment was so substantial that

there are few precedents, so there seems to be a good chance that it can last

for several months at least.

According to Bespoke, it's the most overbought that

ANY of the major US index ETFs has ever been!

Since 1928 for the S&P, 1900 for the Dow, and 1971 for the Nasdaq,

none of these indices have ever been more overbought than the Russell was at

Wednesdays close.

Victor

believes the rally in the small caps (which started on 7/7/24) was mainly due

to short covering. If thats true, he believes that rally is over!

Market Sells Off on Taiwan-China Worries?

The U.S. stock market had a minor sell-off in the last three

days of the past week. Mega cap tech stocks were hit hard, and several pundits

say that the AI stock rocket ship is out of fuel. The previously hot Nasdaq (big tech) and the

S&P 500 (Magnificent 7) cooled off this week (-3.65% and -1.97%

respectively). Yet the S&P is down

only -2.8% from its all-time high on 7/16/24.

Victor

attributes the sell-off to a Donald Trump comment that he would not necessarily

defend Taiwan against China if he were re-elected U.S. President in

November. That set off a decline in

semiconductor stocks like AI darling Nvidia, which spread to other Magnificent

7 stocks. Taiwan is of utmost importance

for the semiconductor industry because its the home of Taiwan Semiconductor

Manufacturing Company (TSMC) -the world's largest foundry. TSMC is a top producer of cutting-edge

semiconductors for major tech companies like Apple, Qualcomm, and Nvidia. TSMC manufactures over 50% of the world's

semiconductors and over 90% of the world's leading-edge logic chips.

-->If

China invaded Taiwan, it could redirect TSMC chip making for domestic

consumption and restrict semiconductor exports to the U.S.

U.S. Economy

and the Fed:

The U.S.

economy is deteriorating very quickly. Initial and continuing unemployment

claims rising and home sales falling.

Thats despite the latest Atlanta Fed's GDPNow

model estimate of 2.7% for the 2nd quarter 2024 on a

seasonally adjusted annual basis. Most

of the GDP growth is due to U.S. federal government spending and hiring.

The U.S. employment situation is weakening with unemployment

rate rising from 3.7% in March 2024 to 4.1% in June 2024. Expect that

number to increase to at least 4.2% in the next BLS Employment report,

which will be released on August 2nd. Vanguard expects a 4.6% unemployment

rate by 2024 years end.

The Sahm rule, named

after a former Federal Reserve economist, is triggered when the unemployment

rate three-month moving average increases by half a percentage point above its

12-month trough. A 4.2% unemployment rate in the July jobs report would

activate this rule, which in the past was a signal of an impending recession.

More importantly, the Conference Boards Leading Economic

Indicators (LEI) for June fell to its lowest level since April 2020.

The index declined 0.2% from the previous month to 101.1. Junes decline in the LEI was led by consumer

sentiment, new orders, yield spread, and unemployment insurance claims. Over the first half of 2024, the LEI fell by

1.9%, a smaller decrease than its 2.9% contraction over the second half of last

year.

Economist David Rosenberg noted that recessions are always

associated with long periods of negative LEI readings. One can clearly see that

in the chart below.

Victor believes the Fed will cut rates at its July 31st

FOMC meeting. Thats despite the CME

Watch Tool forecasting a 96% probability of no rate cut at that

meeting. He forecasts that the Fed will

also cut rates 25 bps at the September 18-19th meeting.

..

Inflation Watch:

The CPI increased +2.97% YoY in June, and its been

declining. Victors favorite gauge that measures rising prices is the Truflation index,

which has been below 3% all year and below 2% since July 1st.

Chart Courtesy of Truflation

Victors Market Positions:

Im long only Gold and 5-year T-Note futures. However, if stocks fall by 5% to 10%, he

would be a buyer of the S&P 500. His

plan is to be flat except for Gold after the Feds September meeting.

It should be noted that commodities, due to the

weakness in the global economy, are up only 6.27% YTD. Victors seasonal

grain trade did not work out this year. It was a loser this season.

Victors Conclusions:

The Federal Budget next year is projected to be $7.3

Trillion. That plus control of the U.S. military is enough power to buy

anything the people in power wish. The cost is the publics liberty, and its

net worth, as inflations base comes from government spending which erodes the

purchasing power of Americans.

Many liberties are eroding daily, as the U.S. government

controls more of what residents can and cannot do. It is becoming more authoritarian than the U.S.

Constitution permits. For more on this theme checkout

this article.

End Quotes:

Our Constitution was made only for a moral and religious

people. It is wholly inadequate to the government of any other. John Adams was

an American statesman, attorney, diplomat, writer, and Founding Father who

served as the second president of the United States from 1797 to 1801.

A man's natural rights are his own, against the whole world;

and any infringement of them is equally a crime; whether committed by one man,

or by millions; whether committed by one man, calling himself a robber, or by

millions calling themselves a government. Lysander Spooner was an

American abolitionist, entrepreneur, lawyer, essayist, natural rights legal

theorist, political philosopher, Unitarian and writer often associated with the

Boston anarchist tradition.

.

Stay calm (easier said than done), good health, success and

good luck. Till next time

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).