Will Chaos at the GOP and Democratic Conventions

Disrupt Financial Markets?

By Victor

Sperandeo with the Curmudgeon

Introduction:

Thursday’s U.S. Presidential debate has immediately changed

politics in the U.S. and could have a huge future impact on the markets!

With repeated stumbling, mumbling, and pausing, often losing

his train of thought, everyone watching saw that President Joe Biden is

suffering from serious dementia. He

often trailed off mid-sentence and mixed up

topics. Also, he did not mention nuclear

war as the number one existential threat to America.

“If he were CEO and he

turned in a performance like that, would any corporation in America, any

Fortune 500 corporation in America keep him on as CEO” asked Joe Scarborough

during a tough opening monologue of his MSNBC show "Morning

Joe."

-->Victor opines that Biden is not capable of being a

manager at Starbucks, let alone the President of the United States.

While he has good intentions, Joe is a sick man and belongs

in a nursing home. It is incredible that his wife and family allowed him to be

humiliated during this debate. We feel

for him and hope he gets the proper care he needs.

The NY Times Editorial Board, Atlanta Journal Constitution, and many

other respected publications stated that Biden should withdraw from the U.S.

Presidential race. A Morning Consult poll revealed that 60% of voters said Biden should

"definitely" or "probably" be replaced as the Democratic

candidate following his performance in Thursday's debate. We agree. However,

Biden said on Friday, and reiterated on Saturday, that he has no intention of

dropping out.

Joe Biden’s Problem:

While senility is a loosely used and somewhat inaccurate and negative reference

to cognitive loss, dementia is the accepted medical term. The The word "senile" here references the age of

onset, which was considered senile if it had developed after the age of

65. Joe Biden is 81 years old and will

be 82 on November 20th.

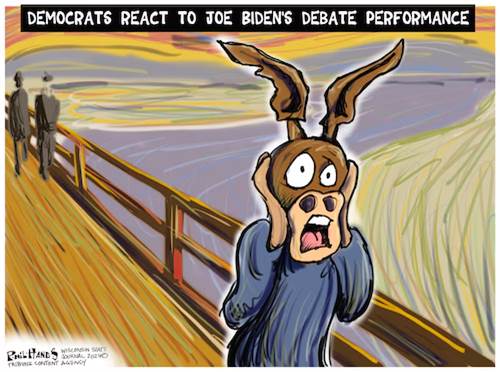

Cartoon of the Week:

There’s certainly a lot to worry about for the Dems!

The above is a parody on Norwegian artist Edvard Munch’s “The

Scream,” created in 1893.

………………………………………………………………………………………………….

Who Might Replace Biden as the Democratic Nominee?

The Democratic party leaders know very well about Biden’s

dementia but now have a huge dilemma of what to do about it. Some of the

highest-profile potential replacements have never endured the vetting and road

test of a presidential race. Here are a

few:

- Vice President Kamala

Harris has at times struggled to define her role at Mr. Biden’s side.

Initially charged with addressing polarizing and intractable issues like

illegal migration and voting rights, she has been viewed by Democratic

donors and supporters of Mr. Biden as a potential political

liability. Furthermore, she has a

lower approval rating than Biden.

- California

Governor Gavin Newsom, the former mayor of San Francisco who also

previously served two terms as lieutenant governor, has become one of Mr.

Biden’s main surrogates during this campaign. Mr. Newsom would be saddled with

explaining the problems California has had over the past decade:

homelessness, high taxes, escalating housing costs. He will probably never

be able to escape his decision in 2021 to hold a high-priced dinner with

lobbyists at the high-end restaurant the French Laundry. He barely survived a recall election in

2021 (the Curmudgeon, a CA resident, voted to recall him).

- Michigan Governor

Gretchen Whitmer has risen quickly as a national star of the

Democratic Party, helped in part by Mr. Trump’s antagonizing her as “that

woman from Michigan.” A two-term governor, Ms. Whitmer led a 2022 campaign

that gave Democrats in the battleground state a trifecta — exercising full

control of the legislature and state government — for the first time in 40

years. Ms. Whitmer is a vice chair

of the Democratic National Committee, a top leadership position in the

national party. Her strengths

include a “disarming” sense of humor and youth, in comparison to the other

candidates.

- Other possible

replacements include Pennsylvania Gov. Josh Shapiro, Maryland Gov. Wes

Moore, and Illinois Gov. JB Pritzker.

However, none of those candidates seem to have enough

experience and “know how” to beat Trump in November. Also, the logistics of changing the

Democratic ticket at the Democratic National Convention (August 19-22, 2024, in

Chicago) would be a political nightmare.

If Biden drops out of the race, his 3,894 pledged delegates

would arrive in Chicago uncommitted to any specific candidate, which

would likely kick off a frenzied fight to win their support. On the first

ballot, a winning nominee would need to secure the votes of a

majority of Democrats’ pledged delegates. If no candidate won a majority

on the first ballot, Democrats would continue on to a

second ballot, in which so-called “superdelegates” would have an opportunity to

vote. Democrats do not have a mechanism

to force Biden out of the race. Unless Biden undergoes a radical change in

thinking or suffers a major health setback in the next few months, he will be

the Democrats’ nominee in November.

Donald Trumps’ Dilemma:

As we previously reported, Donald Trump might be

sentenced to jail on July 11th for 34 counts of felony in a N.Y.

City trial which Victor feels was very unfair.

That’s just a few days before the Republican National Convention, July

15th -18th in Milwaukee, WI. Will the GOP nominate Trump if he’s in jail?

Other issues we previously identified were:

- Will Trump be in jail or under house

arrest in November?

- While Trump could win the U.S.

Presidential election from jail (he’s still ahead in the polls), but it

might be overturned if the Democrats have a majority in the House of

Representatives.

- If a Trump presidential election is

overturned, will the Republican Vice President become the President? In

that case, the GOP pick of a VP candidate is incredibly important. Or will

the second-place Presidential candidate (presumably Joe Biden) take office

in January 2025?

- Section

3 of the 14th Amendment of the U.S. Constitution

disqualifies those who have already held a public office from holding

"any office" if they participate in an "insurrection or

rebellion" against the United States. But since this mechanism has

never been used against a president, there are still questions to resolve.

Outcome of Political Party Conventions and Impact on the

Markets:

Therefore, both political conventions are in jeopardy of turning

into chaos, paralysis and pandemonium. We have two unknown outcomes that the

leading Democratic and Republican candidates may not become their party’s

nominee for President. What will happen

is anyone’s guess, but how will it affect all the markets?

Victor believes that stocks

will run for cover, while bonds will rally. Yields will drop on the short end

of the yield curve, and Gold will zoom higher. Commodities will be mixed. Oil

should rise on any war problems. So will the grains, but copper, lumber, and

steel should decline. The dollar will rally as the world runs to safety. Could the Swiss Franc or the Yen get a bid?

Better to be in Gold and T-bills.

Additional comments:

·

U.S. bonds, notes and

bills must be issued by the U.S. Treasury to finance a U.S.

budget deficit approaching $2 Trillion this fiscal year. What kind of new

budget will be suggested for fiscal year 2025? Both Biden and Trump are big

spenders, but will they be the Presidential candidates? Certainly, the budget

is a big question for each political party.

·

Gold is a chaos hedge and “IF” (for some crazy reason) there is

no election, the 25th Amendment would be invoked, and Kamala Harris would

become U.S. President. What would she

do if China attacked Taiwan? Gold’s price would rapidly rise to above

$3,000/ounce and maybe even $5,000/ounce. More below.

·

U.S. Stocks, which are as overvalued as they have been in all of

history, would decline due to uncertainty and profit taking. There would likely be a run to cash (T-bills

or money market funds).

·

What would the Fed do

if Trump is jailed to Rickers Island (unlikely) or sentenced to home arrest?

That would certainly put a crimp on his election campaign and cause market

disruptions. Would the Fed ease credit to support the markets? That would

certainly look like they are helping Trump.

·

What if a terrorist attack

happens to disrupt the election? The scenarios are too numerous to mention. But

now everything is uncertain and that is an anathema to the markets. More below

in Victor’s Conclusions.

Changes to Victor’s Portfolio:

Sell the S&P 500 (long liquidation), buy long term U.S.

bonds and 5-year T-notes for a trade, stay long Gold.

BofA Global Research on Gold:

BofA’s Michael

Widmer thinks a pick-up in investment demand could push gold to $3,000/oz

(+30%) in the next 12-18 months. Gold ETF inflows, higher London Bullion Market

Association clearing volumes, and continued central bank buying will be key

signals. Global central banks purchased 1,037 tons of gold in 2023 after a

record-high 1,082 tons in 2022. Gold demand should continue to rise as

international central banks reduce US dollar reserves. For example, China’s

U.S. Treasury holdings dropped $102bn in the past 12 months, while gold

holdings have risen 8Moz (about $51bn) since January 2023. Gold is also an

attractive hedge, especially as the U.S. Treasury market becomes more

fragile. BofA warns that the Treasury market is one shock away from not

functioning seamlessly.

The World Gold Council’s latest Central Bank Survey revealed

that 29% of respondents plan to increase gold reserves in the next 12 months,

while 88% cited “long-term store of value / inflation hedge” as the top reason

for central banks to own gold.

Disclaimer: Both Victor

and the Curmudgeon have owned Gold for many decades!

Victor’s Conclusions:

If Joe Biden

is officially out of the Presidential race, and Kamala Harris becomes Commander

in Chief, the U.S. will surely be tested by an adversary. That’s most likely to

be Iran via a terrorist attack by one of its proxies, either within the

U.S. or an overseas U.S. military base.

Iran is a

likely pawn, as any U.S. retaliation would cause oil and gas prices to

spike. If that happened, it would surely

be blamed on the Democrats.

It’s also conceivable that Russia might fire a

non-nuclear missile at a U.S. owned facility to punish America for supplying

Ukraine with Army Tactical Missile Systems (ATACMS), which have a range

up to 300 km. Those missiles were launched by Ukraine against a Russian

airfield in Crimea that was about 165 km (103 miles) from the Ukrainian front

lines, a U.S. official told Reuters. Ukraine used the weapon a second

time overnight against Russian forces in southeastern Ukraine.

Again, if Trump is jailed, and/or Biden drops out (both are

likely), the entire world and global markets will become very volatile!

End Quote:

“If a dog will not come to you after having looked you in the

face, you should go home and examine your conscience.” Woodrow Wilson, 28th President of

the U.S.

Footnote: As a result of a severe

stroke, Woodrow Wilson had similar health issues than Biden. As a result, his

second wife (Edith Bolling Galt Wilson) pre-screened all matters of state,

functionally running the Executive branch of government for the remainder of Wilson's

second term. In effect, she ran the U.S.

government surreptitiously as a shadow President.

………………………………………………………………………………………….

Stay calm (easier said than done), success, and good luck.

Till next time...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).