Big Tech Stocks Outperform; Stocks vs Bonds; a

Perma-Bears Warning

By the

Curmudgeon

The Beat Goes On:

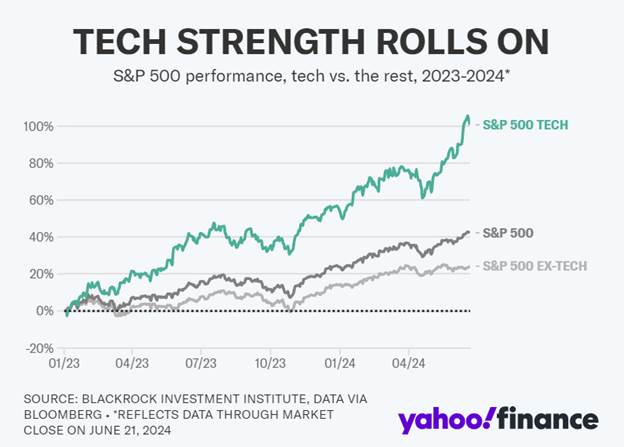

Weve noted in many recent Curmudgeon posts that this year's

stock market rally has been led by just a few big tech names. AI darling Nvidia (NVDA) has accounted for nearly

one-third of the S&P 500's gains this year.

As of the close on June 24th, Apple (AAPL), Alphabet (GOOG,

GOOGL), Microsoft (MSFT), Amazon (AMZN), Meta (META), and Broadcom (AVGO) had

also contributed more than a quarter of the S&Ps gains in 2024.

The DJI (3.77% YTD) and Russell 2000 (-0.23% YTD) were both

down on June 25th, but big tech rallied strongly. That boosted the

NASDAQ which rose +1.26%. Also, NVDA

closed +6.76%, GOOG +2.65%, META +2.34%, MSFT +0.73%, while other big tech

stocks also rallied today.

Outperformance in quarterly results from large-cap tech

continues to be a reason why earnings for the S&P 500 are growing year over

year. Investors have gorged on large-market-cap stocks that have held up well

in the higher rate environment and are seeing earnings grow more than their

smaller peers. Big tech outperformance

is clearly depicted in the chart below:

Dont Worry About Narrow Breadth???

Morgan Stanley's chief investment officer, Mike Wilson, found

that only 20% of the top 500 stocks are outperforming the broader index over a

rolling one-month period. This is the lowest

percentage of companies outperforming in Wilson's dataset dating back to 1965.

"Narrow breadth can persist but it's not necessarily a

headwind to forward returns in and of itself," Wilson said. "We

believe broadening is likely to be limited to high quality/large cap pockets

for now."

Cartoon of the Week:

Cartoon

courtesy of Hedgeye

..

U.S. Stock vs Bond Index

Returns:

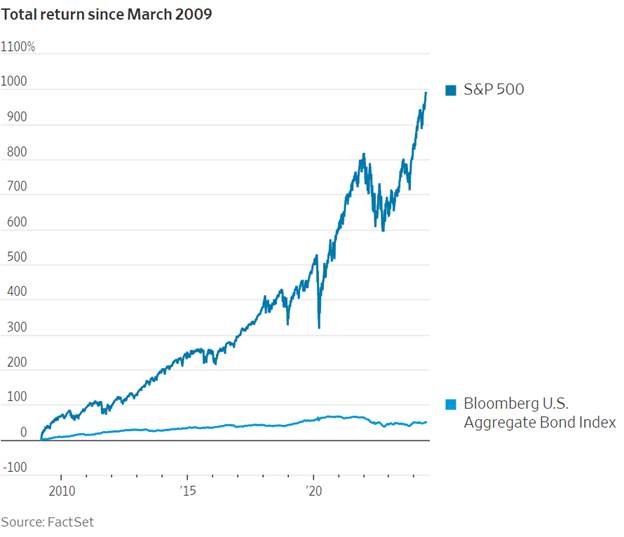

Another recurring theme this year has been stocks rising

strongly while U.S. Treasury notes and bond prices have fallen. The outperformance of stocks over bonds

since 2009 is even more striking.

According to Dow

Jones Market Data via the Wall Street Journal, the S&P 500 has logged a

total return of more than 980% since U.S. stocks bottomed in March 2009. Contrast

that to the Bloomberg U.S. Aggregate Bond indexs total return of only 50% over

the same period.

ΰThat means stocks have returned 19.6 times the total

return on bonds for the last 15 years and 3 months! Thats a big WOW!

A Perma-Bear Rings the

Bell at the (Presumed) Top:

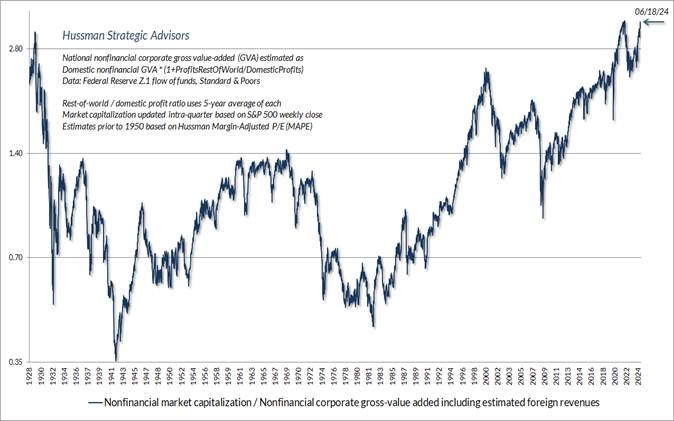

In his latest market commentary (June 24th), self-proclaimed

Perma-Bear John

Hussman wrote (emphasis added):

The main reason I have not advocated a constructive stance

since 2021 is that market internals have

remained divergent throughout this period, valuations remain beyond 1929

and 2000 extremes, and my view remains that the period since 2021 comprises the

extended top formation of one of the three great

speculative bubbles in U.S. (stock market) history.

Based on the present combination of extreme valuations,

unfavorable and deteriorating market internals, and a rare preponderance of

warning syndromes in weekly and now daily data, my impression is that the speculative market advance since 2009 ended

last week. Barring a wholesale shift in the quality of market internals,

which are quickly going the wrong way, any further

highs from these levels are likely to be minimal. In contrast, current

valuation extremes imply potential

downside risk for the S&P 500 on the order of 50-70% over the

completion of this cycle.

The chart below shows Hussmans most reliable gauge of market valuations, based on correlation

with actual subsequent S&P 500 total returns in market cycles across

history. The chart shows the ratio of nonfinancial market capitalization to

gross value-added, including estimated foreign revenues. The present level

exceeds both the 1929 and 2000 extremes and is higher than every point in

history except for five weeks surrounding the January

2022 market peak.

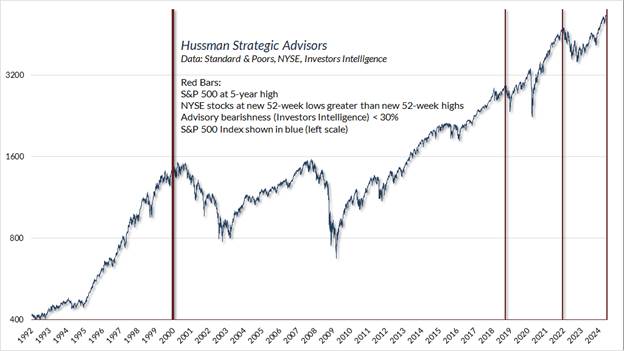

Heres something you dont see very often: a 5-year high in the S&P 500 with

negative leadership (more stocks at new 52-week lows than new highs),

particularly coupled with very little bearish sentiment. That combination, as

simple as it seems, is an indication of trouble under the surface. We saw this

one on Monday, June 17th.

In sum, a simplified way to understand our market outlook is

that valuations inform our long-term and full-cycle views, market internals

inform our intermediate term views, and a boatload of weekly and daily

syndromes relating to overextension, compression, phase transition, and reversal

inform our near-term views. I dont think its generally possible to identify

market peaks and troughs in real-time, but there are unusual points in history

when one observes a sudden deluge of conditions that suggest a speculative

climax or risk-averse capitulation. Our investment discipline is to align our

outlook with observable, identifiable, quantifiable measures, and no forecasts

are required. Its just that every now and then, those observable measures

arrive by the bucketful.

Even a speculative peak would not necessarily imply

immediate market losses. Both the closing and intraday peaks of the tech bubble

occurred on March 24, 2000, followed by a steep initial decline. But the

S&P 500 clawed its way to nearly the same level by September 1, 2000, and

slightly exceeded the March 24, 2000 high on a total

return basis. Likewise, the motherlode of warning flags we observed in

November 2021 was followed by an initial decline, but the closing high of the

S&P 500 occurred several weeks later, on January 3, 2022, at a level about

1.1% above the late-November intra-day high.

.

Be well, stay calm,

success and good luck. Till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).