Update on Reverse Repos

and a Possible U-turn in Fed Policy

By Victor

Sperandeo with the Curmudgeon

Introduction:

We provided a detailed explanation of Reverse Repos in a Sperandeo/ Curmudgeon post titled, “RRP’s:

Wall Street Newcomers Need a Monetary Education!” This article

includes a RRP update with a startling finding you won’t find anywhere

in the mainstream media. We also speculate that President Biden will pressure

the Fed to end its “higher for longer” hawkish talk and reduce interest rates

prior to the November elections.

An Email Exchange About

RRPs:

A long time ago associate of Victor emailed him this morning

to ask, “What does the reverse repo market tell you right now?” Here was his reply:

There is a

great misconception about reverse repos and repos. An Overnight reverse repo (RRPs) is a transaction where the Fed sells

a security to an eligible counterparty and agrees to buy it back the next day

at a set price. Eligible counterparties include banks, government sponsored

enterprises, Fed primary dealers, and money market funds. As money is taken out of the U.S. financial

system when the Fed sells an RRP, it is a “drain” or reduction of the money

supply which is intended to curb rising prices.

RRPs are a fairly recent Fed tool.

The Fed began testing the overnight reverse repo facility in September

2013 and started to implement it in December 2015. When the Fed wants to stimulate economic growth,

it allows RRPs to mature, which puts money back into the real economy. That’s

been happening since 2023 as depicted by the chart below.

The peak RRP value was $2.425 trillion on 9/30/22 (except for

a slight spike on 12/30/2022 to $2.553 trillion for year-end window

dressing). Today, there is only $431.29

billion in RRPs.

→ Approximately $2 trillion has been injected into the

U.S. financial system via matured RRPs during the last 20 months! That was

during the same time that the Fed continued to RAISE the Fed Funds rate,

implement Quantitative Tightening (QT) and perpetuate

its “higher for longer” interest rate campaign. In essence, the Fed was tightening credit with one hand (higher Fed

funds rate and QT) while loosening credit (by letting RRPs mature).

The net

increase in financial liquidity is part of the reason GDP has been strong (“no

recessions allowed”) and U.S. stocks have been in a bull market since October

2022 (the month after the total amount in RRPs peaked). Victor

believes this reflects the Fed’s goal of keeping the economy strong into the

November U.S. elections.

Analysis of the FOMC

Meeting Minutes and End of Fed’s Hawkish Drumbeat:

The April-May FOMC meeting minutes were released on

May 22nd after the markets closed. As usual, the gang talked the markets down

by grousing about rising inflation, but left the door open for a rate cut at

the September 2024 FOMC meeting. The Fed’s hawkish comments were carried into

Friday and the markets had a minor correction, including Gold and Silver.

Victor believes the “higher

for longer” Fed comments will stop sometime in June. President Joe Biden’s approval rating is dropping like a stone. According to Reuters, just 36% of Americans

approve of Biden's job performance, down from 38% in April. It was a return to

the lowest approval rating of his presidency, last seen in July 2022. So, in a month or so, Biden will instruct the

Fed to “turn around the Wagon Train.”

The economic numbers will likely get worse until Biden tells

the Fed to come to the rescue. According

to the CME Fed Tool, there is now a 49.4% probability of

a 25 bps or 50 bps rate cut at the September FOMC meeting. We

expect that probability to increase substantially next month.

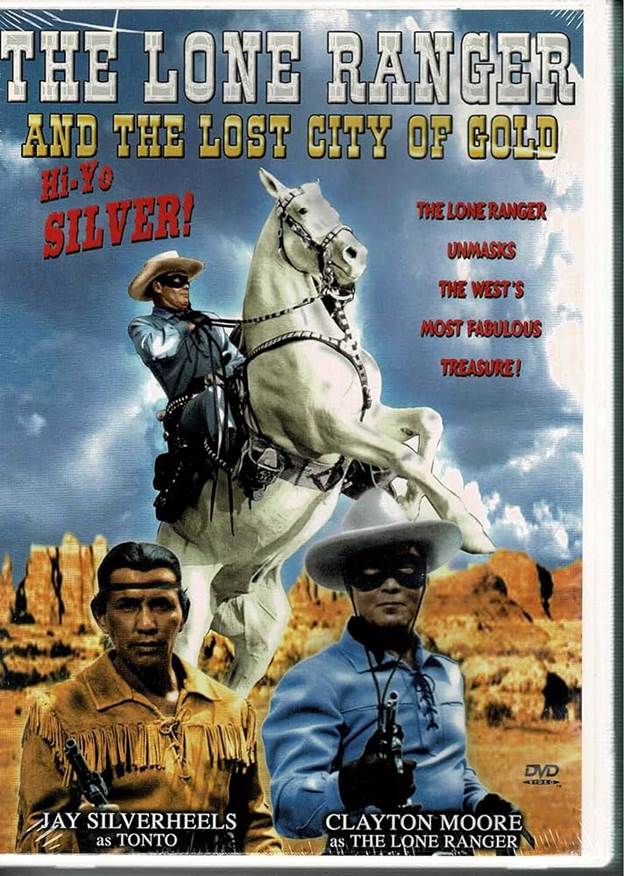

As “The Lone Ranger”

used to say “Hi-Ho Silver Away.”

That was the theme song of this very popular TV program which the Curmudgeon

and I enjoyed tremendously while living in NYC.

Apropos is

an episode titled “The Lost City of Gold,“ in which the Lone Ranger

and Tonto investigate a series of mysterious murders which have a sinister

pattern. Peaceful native American

Indians are the victims of a gang of hooded killers. The Lone Ranger and Tonto

discover that missing medallions may lead to hidden gold. The Ranger uses disguises as only he can do

to piece together clues and expose the outlaw band and bring them to justice. The concept of a lost city filled with gold

can symbolize the allure of myths and legends versus the harsh realities of

life.

In recent years, the U.S. government and the Fed seem to be

chasing dreams and fantasies, while failing to confront the practical

challenges and disappointments that come with living in the real world. This is particularly true for out-of-control

U.S. government spending (resulting in huge budget deficits) and higher

interest rates leading to increased debt servicing costs (which further

increase budget deficits and the national debt).

Victor’s Conclusions:

The $130 trillion U.S. bond market (capitalization) is losing

its status as a safe haven. U.S. bonds have been in a major bear market

since June 2020. It’s being replaced by

the $65 Trillion stock market and the $14 Trillion gold market which have been

on the rise.

If not for the upcoming November U.S. elections, U.S. 10-year

yields would be as high as 6% (vs ~4.5% recently). The U.S. government and the

Fed are going to have to create a new trick to manipulate the problems they’ve

created with excessive spending, enormous budget deficits and “higher for

longer” interest rates.

End Quotes:

As Ollie (Hardy)

said to Stanley (Laurel):

“Well here’s another nice Mess

you’ve gotten me into!”

Picture Fed Chairman Jerome Powell talking to U.S. Treasury

Secretary Janet Yellen saying:

“You can’t get out of here that way. Oh, yeah? Why not?

Because the door is over here.” – Oliver

Hardy

Laurel and Hardy were internationally famous for their

slapstick comedy, with Laurel playing the clumsy, childlike friend to Hardy's

pompous bully. Victor says they were the

best comedy team in history!

……………………………………………………………………………………………

Be

well, success, good luck and till next time……………………..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).