U.S. Policy Changes and Across the Board Trickery Fuel

the Rise in Risk Assets

By Victor

Sperandeo with the Curmudgeon

Introduction:

Victor and the Curmudgeon agreed that an explanation of U.S.

government and Fed policy changes since 2008 would be appropriate for this

week’s column. Those changes have

changed the secular trend of many markets, defied the business cycle (“no

recessions allowed”) and produced what seems to be an endless stream of global

liquidity that has fueled the rise in risk assets (e.g. stocks and gold) to new

all-time highs.

Post 2008

U.S. Policy Changes Explained:

After Barack Obama was elected President in November 2008,

the U.S. began a transformation into a more controlled country bordering on

socialism. In a major way, this was to prevent another “Great Recession” of

December 2007-June 2009.

Interest rates went to zero (ZIRP) and the QE cult (keystroke

entries/money printing to buy bonds) became a dedicated and permanent part of

Fed monetary policy.

This type of money printing greatly inflated the price of

financial assets (stocks and bonds) and other hard assets (mainly real estate)

but did not increase consumer prices (the CPI).

There were two main reasons for the low CPI after 2008:

1. The Fed paying its member banks interest on

reserves, which incentivized banks to NOT make loans.

2. The “Dodd-Frank Law”

which changed the swap margins on commodities, thereby lowering Pension Funds

desire to buy them.

A January 1946 article, “Taxes For Revenue Are Obsolete” by Beardsley Ruml,

Chairman of the Federal Reserve Bank of New York, offered four reasons why

modern nation-states didn’t need taxes to fund operations — they had other

tools at their disposal. Reason #3: “To express public policy in subsidizing or

in penalizing various industries and economic groups.”

Indeed, this tactic was applied after 2008 as the U.S.

federal government started to pick winners and losers!

Also, the BLS started to manipulate the CPI and job numbers

to allow the federal government to execute a political agenda.

- One such BLS

change is substituting “Owners’ Equivalent Rent (OER)” for actual

rent (compiled by Zillow) to make the CPI higher than it actually was.

That BLS skullduggery gave the Fed cover to keep interest rates

“higher for longer,” even though the Fed prefers the PCE index to the CPI.

- Another BLS subterfuge

is to make the job numbers look better than forecast, then revise them

down the following month.

We have described BLS chicanery at length in several

Curmudgeon posts, like this one on OER and this one on finagling

the job numbers.

Global Liquidity Fuels Risk Assets:

We’ve previously discussed the hocus pocus that’s led to increased

global liquidity, despite the Fed’s higher for longer interest rates and

Quantitative Tightening (QT) in this

post.

According to Michael Howell's Cross Border Capital “Global

Liquidity Watch” weekly update for the week ending May 7th,

global liquidity increased by $510 billion to $171.85 trillion. The

increase was due to a rise in the Shadow Monetary Base and a decrease in

volatility in key collateral markets.

…………………………………………………………………………………………………

Long Term Macro Economic Changes:

In 2015, the markets’ economic themes included: low CPI, zero

interest rates, stable gold and commodity prices and secular up-trends in both

stocks and bonds.

In 2020, the economic and market themes changed due to

government ordered shutdowns in response to the Covid-19 pandemic. The response was an unprecedented and

enormous U.S. government stimulus with the Fed buying all sorts of

non-government assets including junk bond ETFs.

Government stimulus and unconventional monetary policy led to

a massive increase in the money supply which caused inflation to accelerate. It

also started a bear market in bonds (low in yields) and the beginning of a new

bull market in most risk assets.

Huge government spending and never

before seen peacetime U.S. government deficits ($3.132 Trillion

in 2020, in $2.772 Trillion in 2021, $1.376 Trillion in 2022, and $1.694

Trillion in 2023) forced the U.S. Treasury to auction a tremendous amount

of new debt each year, most of which has been monetized by the Fed.

That’s Modern Monetary Theory (MMT) in action (see End

Quote below).

Below is a chart showing U.S. budget deficits from 2001 to

2023. Note that the U.S. had a budget SURPLUS of $0.24 Trillion in fiscal 2000!

Source: U.S. Treasury

Dept

Please visit the Monthly Treasury Statement (MTS) dataset to explore and

download this data.

Increased Demand for Gold:

The former biggest foreign buyers of U.S. debt - China and

Japan - are no longer the sucker at the table buying depreciating U.S. bonds.

Instead, Gold is being bought by global central

banks. Overall, gold demand from central

banks totaled 1,037.4 metric tons in 2023, just below the record high set in

2022 at 1,081.9 metric tons, according to the World Gold Council. Gold demand

among central banks has been at more than 1,000 metric tons for the last two

years.

Also, the 2017 Basel III Endgame rule change

reclassified physical gold as a Tier 1 asset, making it comparable to cash and

government bonds on bank balance sheets. This change requires banks to hold

less capital against their gold holdings, which has made gold more attractive

to banks as a reserve asset.

.....…....…....…......…....…....…....…....…....…....…....…....…....…....…......…...

Victor’s Current Observations:

1. The Bank of Japan (BoJ) Is buying ETFs to

revitalize Japan's corporate sector, lowering the cost of capital by making

more funds available and encouraging more risk-taking activity in the economy.

BoJ sees stocks as a very effective way to stimulate Japan’s economy which has

been in the doldrums for decades.

2. The U.S. economy is deteriorating fast, but the economic

numbers are mixed.

a.] GDP is strong due to robust U.S. government spending. The

Atlanta Fed's GDP Now [1.] is annualized at +3.6% as of

May 16th.

Note 1. GDPNow is not an

official forecast of the Atlanta Fed. Rather, it is best viewed as a running

estimate of real GDP growth based on available economic data for the current

measured quarter. There are no subjective adjustments made to GDPNow—the

estimate is based solely on the mathematical results of the model.

b.] The Conference Board Leading Economic Index® (LEI) for the U.S. decreased by 0.6% in April 2024 to

101.8 (2016=100), after decreasing by 0.3% in March. LEI’s April decline was

driven by consumer sentiment, new orders, a negative yield spread and building

permits. Over the six-month period between October 2023 and April 2024, the LEI

contracted by 1.9% vs its 3.5% decline over the previous six months.

“The LEI for

the U.S. declined for the thirteenth consecutive month in April,

signaling a worsening economic outlook,” said Justyna Zabinska-La

Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

“Weaknesses among underlying components were widespread—but less so than in

March’s reading, which resulted in a smaller decline. Only stock prices and

manufacturers’ new orders for both capital and consumer goods improved in

April. Importantly, the LEI continues to warn of an economic downturn this

year. The Conference Board forecasts a contraction of economic activity

starting in Q2 leading to a mild recession by mid-2023.”

3. The key point I

continue to emphasize is “no U.S. recession” this year as the

politicians in power will pull out all stops to prevent it. This is

accomplished by fudging the employment data, using “Seasonal Adjusted” data and

the “Birth/Death model (BDM)” to make the real economy look better than it actually is.

4. Last week, the precious metals went on a tear with Copper,

Platinum, and Silver breaking out to new intermediate term highs. Gold followed and is very near an all-time

new high.

Silver above $30/troy ounce is a big deal technically (spot

silver price is currently $31.49/troy ounce)!

The breakout in metals to new highs coupled with the

Biden administration’s escalation of tariffs on imports from China, portends

more inflation ahead along with a weaker U.S. dollar.

End Quote:

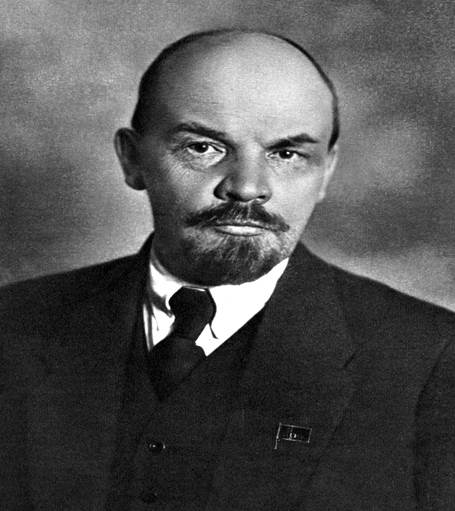

The sentiments of a world-renowned tyrant ring true today:

“The best way to destroy the capitalist system is to debauch

the currency.” Vladimir Lenin

Be well, success and good luck. Till next time………………..

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).