Stock vs Bonds, Inflation Watch, Consumer Sentiment and

Geopolitics

By the

Curmudgeon with Victor Sperandeo

Stocks and Bond Market Returns Diverge:

The S&P 500 index increased 1.9% to 5,223 last week and

is within 1% of its record all-time high.

On Friday, Fed “Goons” came out of the woodwork to temper the rally

using moral suasion. Fed Governor

Michelle Bowman said she doesn't expect it will be appropriate for the Fed to

cut interest rates in 2024, citing persistent inflation in the first several

months of the year.

The S&P has returned ~10% this year. The QQQ ETF (proxy

for the NASDAQ 100) has a 2024 year-to-date (YTD) return of 8.09% and a

one-year return of 36.86%. At the same

time, bond prices have declined. As of

May 10, 2024, the iShares 20+ Year Treasury Bond ETF (TLT) had a 2024 YTD total

return of -7.66% and a 1-year return of -10.11%.

It is very unusual for U.S. stocks to be in a bull market for

19 months (since October 2022), while U.S. government bonds are in a prolonged

bear market for almost four years.

·

The 10-year U.S. T-note yield

closed Friday at 4.504%, which is 8.75 times higher than its 0.515% close on

August 4, 2020!

·

The TLT ETF declined from

$171.57 on August 4, 2020, to $90.12 on Friday, May 9, 2024, for a loss of

47.5%.

·

In sharp contrast, the

S&P 500 closed at 3,306.51 August 4, 2020, vs 5,223 on Friday, May 9, 2024,

which is a +58% return (not including dividends).

Inflation Watch:

The CPI

report this coming Wednesday, which will follow Tuesday’s PPI report, will

provide a good gauge of the direction of inflation in the U.S.

Economists

estimate that consumer prices rose 0.4% month-on-month, flat versus March, and

increased 3.4% year-on-year, easing from 3.5% in March. Core CPI, which strips

out food and energy costs, is expected to have risen 0.3% month-on-month and

3.6% year-on-year, down from 3.8% in March.

The Fed’s preferred inflation measure, the personal consumption expenditures

(PCE) price index, will be reported on May 31st.

Meanwhile, consumers’

inflation expectations have moved up, as per last week’s University of

Michigan Consumer Sentiment report. Over the next 12 months, consumers anticipate

prices to be up 3.5%, versus 3.1% in last month’s survey. That’s above the

2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation

expectations inched up, from 3.0% last month to 3.1% this month. Although they

have been within the narrow 2.9-3.1% range for 30 of the last 34 months,

long-run inflation expectations remain elevated relative to the 2.2-2.6% range

seen in the two years pre-pandemic.

"The

Fed is unlikely to cut rates, absent the onset of recession, unless inflation

is clearly headed sustainably to 2%," Conrad DeQuadros,

senior economic advisor at Brean Capital. "Anchored inflation expectations

are a key part of this assessment, and a 3.1% longer-term expectation is near

the high end of the range that the Fed judges as being anchored."

Consumer

Sentiment Plummets!

The

University of Michigan reported that Consumer Sentiment retreated ~13% this May

following three consecutive months of very little change. This 10 index-point

decline is statistically significant and brings sentiment to its lowest reading

in about six months. This month’s trend in sentiment is characterized by a

broad consensus across consumers, with decreases across age, income, and

education groups. Consumers in western states exhibited a particularly steep

drop. While consumers have been reserving judgment for the past few months,

they now perceive negative developments on a number of dimensions. They

expressed worries that inflation, unemployment, and interest rates may all be

moving in an unfavorable direction in the year ahead.

Victor: I think the Michigan

Consumer Sentiment report reflects the real economy; not the one created by

U.S. government spending which now shows 4.2% GDP estimate for 2Q-2024,

according to the Atlanta Fed GDP Now.

………………………………………………………………………………………………………..

It’s

interesting to note that Consumer Sentiment has been well below

pre-Covid years (see chart below), while stocks have been in a secular bull

market since then, while bonds are in a major bear market!

Source: University

of Michigan

…..…………………………………….…..…………………..…..……..…..…….……

Victor’s Market Comments:

Victor thinks the Fed and the U.S. government don’t want a

stronger U.S. stock market until after the FOMC June 11-12th

meeting, at which time they will mute their “sticky inflation” narrative. The election is the goal (to retain power)

and the $7.3 trillion U.S. government spending budget the prize.

Starting in July, expect to see lower CPI reports from the

BLS and lower employment numbers, setting the stage for two Fed Funds rate

cuts. Fed funds futures again are

pricing in two possible 25bps rate cuts by year end, according

to the CME FedWatch site.

Stocks and Gold are strong holds currently, while commodities

and bonds will be buys (FOR A TRADE) next month after the FOMC meeting. ALL THE

TALK ON “STICKY INFLATION” WILL THEN STOP.

The grains have started their rally already, as I suggested,

and will continue to rally into August. Wheat, corn, and soybeans can do very

well based on weather and will move up in hopes of a drought.

Let me also say that all must be reevaluated on September

30th. The election is an unknown with large risks.

Current Critical Issues:

Geopolitics are the real

potential problem for the world. Here are two of them:

1. The veiled threats by French President Emmanuel Macron to

send troops into Ukraine (perhaps French Legionnaires?) would be a disaster.

Macron has, over the past few months, mulled the dispatch of Western ground

troops into Ukraine, saying, recently, in an interview with The Economist, “I’m

not ruling anything out, because we are facing someone who is not ruling

anything out.”

Russia will target any French troops in Ukraine and has

threatened nuclear missiles at France and any other NATO countries who send

troops to fight there.

This is a Napoleon complex bet that could end the world. Yet it’s not discussed in the Mainstream

Media (MSM). Why not?

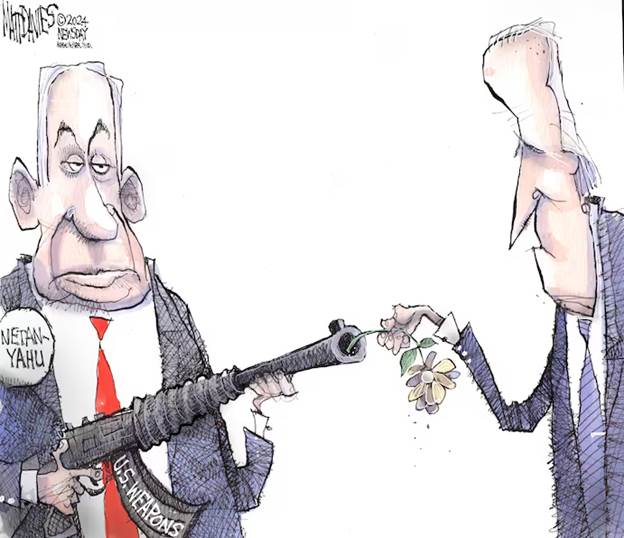

2. Alarmingly, U.S. President

Joe Biden said for the first time on Wednesday that he would halt some

shipments of American weapons to Israel if Prime Minister Benjamin Netanyahu

orders a major invasion into Rafah in southern Gaza.

“Civilians have been killed in Gaza as a consequence

of those bombs and other ways in which they go after population centers,” Biden told CNN’s Erin Burnett in an

exclusive interview on “Erin Burnett OutFront,” referring to 2,000-pound bombs

that Biden paused shipments of last week.

The U.S. president’s announcement that he was prepared to

condition American weaponry on Israel’s actions amounts to a turning point in

the seven-month conflict between Israel and Hamas. It could potentially fracture the 76-year

U.S. alliance with Israel. That’s exemplified by this cartoon:

Image Credit: Matt Davies/Newsday

Israel will

ignore Biden and proceed with a tactical invasion of Rafah in order to destroy

Hamas. Indeed, Israeli forces pushed

deeper into Rafah on Sunday and battled Hamas in parts of the devastated north

that the military said it had cleared months ago, but where Hamas militants

have regrouped.

Rafah is

considered Hamas' last stronghold. It is also the last refuge in Gaza

for more than a million civilians. Some 300,000 Palestinians have fled the city

following evacuation orders from Israel, which says it must invade to dismantle

Hamas and return scores of hostages taken in the Oct. 7 attack against Israel

that sparked the war in Gaza.

The Israel

Defense Force (IDF) announced that it has opened a new crossing to bring

humanitarian aid into the famine-stricken Gaza.

The Israeli military announced in a Sunday press release the opening of

the "Western Erez crossing" between Israel and northern Gaza in

coordination with the U.S.

According to

the IDF, the new crossing is located west of the Erez crossing, closer to the

seashore. The crossing was constructed by the Israeli military "as part of

the effort to increase routes for aid to Gaza, particularly to the North of the

strip."

Victor’s

Conclusions:

If Israel

does not destroy Hamas, the October 7th attack will happen many

times over by the enemies of the Jewish state (e.g. Iran and it’s Islamic Jihad

proxies).

Once again,

the U.S. is again telling another sovereign nation (Israel) what to do and is

more than overstepping its authority.

This seems

to be an obsessive-compulsive-reflexive-imperative mania to overestimate U.S.

power and influence while underestimating its most important allies like

Israel!

It is yet

another example of what you see from the U.S. government today-- extortion,

bribery and using the threat of force to CONTROL AND RULE THE WORLD.

End Quote:

“The only way to deal with an unfree world is to

become so absolutely free that your very existence is an act of rebellion.”

Albert Camus

…………………………………………………………………………………………………

Be well, success and good luck. Till next time……………….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2024 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).