Non-Seasonal Adjusted Jobs Data Shows a Not So Hot US

Job Market

By Victor Sperandeo

with the Curmudgeon

Introduction:

The ADP employment report released Thursday showed a

+497,000 increase in jobs. Yet on Friday,

the BLS reported Non-Farm payrolls rose

+209,000 (Seasonally Adjusted) in June with only 149,000 private sector jobs

created. Who’s right?

Let’s explore jobs, CPI, upcoming Fed meetings and the impact

on financial markets in this post.

Analysis of BLS Jobs Report:

Jobs added in June were nearly +100,000 positions below May’s

stronger-than-expected showing of +306,000 and fell below economists’

expectations for a net gain of +225,000 jobs.

It’s the lowest monthly gain since a decline in December

2020, and — excluding the losses seen during the first year of the pandemic —

June’s jobs added number is the smallest since December 2019.

Also, the BLS revised down new jobs created from the

last two months by -110,000. The change

in total nonfarm payroll employment for April was revised down by 77,000, from

+294,000 to +217,000, and the change for May was revised down by 33,000, from

+339,000 to +306,000.

Therefore, BLS now says that from January to June of 2023 an

average of +244,000 monthly new jobs were created.

However, if you use the actual Non-Seasonal Adjusted (NSA)

numbers and deduct the Birth Death Model estimated +638,000 (NEVER counted

Jobs) you get an average of +163,500 monthly new jobs for 2023 till June

30th. That clearly shows the job market

is not as “hot” as the MSM says it is. Yet pundits continue to argue the

labor market is super strong?

The Federal Reserve Board places a great deal of emphasis

on the BLS numbers to formulate their monetary policy (which is now focused on raising

interest rates). So, it would seem

obvious that “accuracy” be tantamount in the BLS calculations.

For example, the May BLS jobs report showed an outsize gain

of +339,000 in payrolls, but its Household survey showed the number of

employees plunged that month. That’s a

huge discrepancy!

For these and other reasons, many economists and market

analysts are now questioning the BLS jobs numbers.

The Next CPI Report:

The CPI report for June 2023 will be released on July 12th.

Nowcasts from the Federal Reserve Bank of Cleveland

estimate that CPI inflation will come in at over 0.4% for the month of June

2023.

Economists forecast that the CPI will increase 3.1% year over

year (YoY), nearly a full percentage point less than in May.

The core CPI, which excludes volatile food and energy prices,

is seen rising 5%, three-tenths of a percentage point less than previously.

The CPI is at its lowest level since March 2021, and the core

CPI lowest since November 2021. We noted the declining CPI and PCE (the Fed’s

favorite inflation gauge) in last week’s column which you can read here.

Outlook for Future Fed Meetings this Year:

According to the CME

Fed Watch Tool, there’s a 92.4% probability of a 25bps Fed Funds rate increase

at the July 25th -26th FOMC meeting. Fed officials continue to talk up more rate

hikes this year.

Federal Reserve Bank of Chicago President Austan Goolsbee, a

voting member of the Fed committee that decides interest rates, said in an

interview Friday that he sees “a decent chance of further tightening down the

pipeline” and that inflation “needs to come down more.”

Other Fed officials have struck a similarly hawkish tone on

inflation, hinting strongly at a hike in July and another in September.

So, we have the Fed playing a Nostradamus soothsayer? How do they know what will occur in the U.S. economy in the

coming months?

Impact on Financial Markets:

The Fed’s mere threats are causing the debt markets to price

in two more rate increases this year. Rates

have been rising sharply since the last FOMC meeting on May 3rd.

On May 4, 2023 (1 day after the Fed meeting), the 6-month

T-Bill yielded 5.04% and the one-year bill yielded 4.59%. As of Friday July 7th, the 6-month

T-Bill yield is 5.53% and the one-year T-Bill is at 5.41%. That’s an increase

of + 0.49 bps and 82 bps, respectively!

The 2 Year T-Note yielded 3.729% on May 3rd but

touched 5.12% earlier this week- the highest level since June 2007.

Now consider the 10-year yield, which was 3.37% on May 4th but

jumped to 4.06% on Friday July 7th.

That’s a +69 bps increase in three trading

days!

Meanwhile, the 2-year vs 10-year U.S. Treasury yield curve is

now the most negative since 1981 as per this chart:

More interestingly… the S&P 500 is +8.32% from May 4th to

July 7th while the NDX 100 is +15.82%!

That’s a dilemma for the Fed, as rising interest rates seem

to be a huge plus for mega tech stocks, yet they’ve caused short term and

intermediate interest rates to rise. The

latter weakens the economy, killing small business and making financing much

more difficult for home and car buyers.

Victor’s Conclusions:

The BLS jobs numbers and CPI are mere apparitions of

inflation, while Fed rate increases are very real and lethal!

Why doesn’t anyone in Congress object other than Elizabeth

Warren, U.S. Senator from Massachusetts?

Closing Quote:

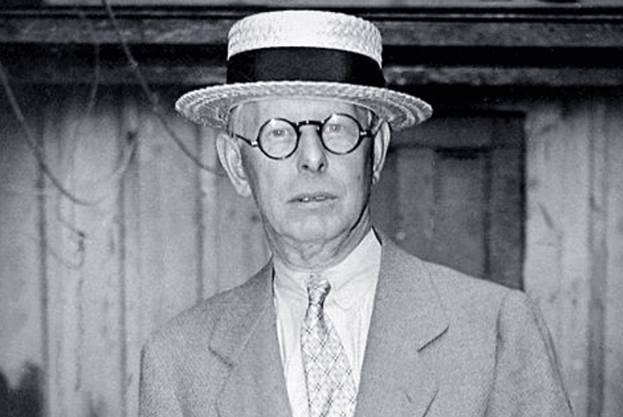

“Speculation is a hard and trying business, and a speculator must be on the job

all the time, or he'll soon have no job to be on.” Jesse Lauriston Livermore

….……………………………………………………………………………..

Be well, stay safe, success, good luck and till next time……

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).