A Scam to

Make Soaring Budget Deficits Look Smaller

By Victor

Sperandeo with the Curmudgeon

Backgrounder on U.S. Budget Deficits:

Deficits did matter in the 1980s under President

Reagan, as increasing U.S. budget deficits created a fear that the private

sector would be crowded out by massive government borrowing. Bond vigilantes would go on a buyers strike

to force the federal government to lower budget deficits and resulting

borrowing.

Modern Monetary Theory (MMT) came along in the early 1990s to suggest the government can

create more money without any consequences as its the issuer of the currency

(in this case, the U.S. dollar the worlds reserve currency). That was followed by the Federal Reserves QE

programs (starting in November 2008) to buy most of the newly issued U.S.

government debt. Hence, budget deficits

were no longer a concern for financial markets or the U.S. economy.

U.S. Budget Deficits Skyrockets while GDP is

Positive:

In the first six months of fiscal year 2023, the

United States borrowed $1.1 trillion, with a $376 billion deficit in February,

according to the latest Monthly Budget Review from the Congressional Budget Office

(CBO). Maya MacGuineas,

president of the Committee for a Responsible Federal Budget said, Only halfway

through the fiscal year and weve already borrowed $1.1 trillion a massive $6

billion per day. Yet lawmakers have done little to write a budget and figure

out a plan for how to slow this endless flow of borrowing.

This reality of the six-month deficit being $1.1

trillion, assumes another $1.1 trillion deficit from April to September. This

is occurring as the U.S. economy, measured by real GDP, is still growing.

Its critically important to note that as the U.S.

economy goes into recession (as Fed economists now forecast), budget deficits will

greatly increase as tax revenues decline and transfer payments increase.

Curmudgeon Note:

A recent IRS ruling will widen the budget deficit from January

1st to October 15, 2023. Disaster-area

taxpayers in most of California and parts of Alabama and Georgia now have until

Oct. 16, 2023, to file various federal individual and business tax returns and

make tax payments.

The Oct. 16 deadline also

applies to the estimated tax payment for the fourth quarter of 2022, originally

due on Jan. 17, 2023. This means that taxpayers can skip making this payment

and instead include it with the 2022 return they file on or before Oct. 16, 2023

estimated tax payments, normally due on April 18, June 15 and Sept. 15, as well

as quarterly payroll and excise tax returns normally due on Jan. 31, April 30

and July 31 are now due on Oct. 16.

ΰWithout tax revenue from disaster

area taxpayers until Oct. 16, the budget deficit from January 1 to Oct. 15 will

increase more than previously forecast.

Is the National Debt Sustainable?

U.S. national debt is growing at 7.65% annually from

2000 to date! The debt is growing more than 4.32 times real GDP using the CPI

(which is 20 bps higher than the GDP deflator)1.

Note 1. From 2000 to now (last

23 years), the real GDP growth annual average rate was 1.97% using the GDP

deflater, while Nominal GDP was 4.31%. But using the CPI, real GDP grew at a

lower rate of 1.77%.

This is obviously unsustainable. However, a

government with a printing press (aka Fed keystroke entries) may be able to

extend the national debt beyond the rationally obvious?

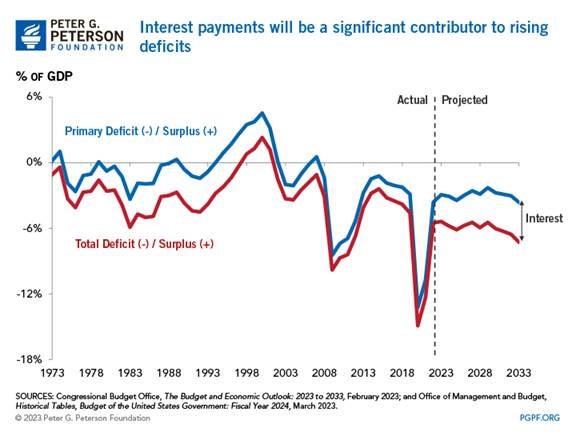

A New Misleading Concept Primary Deficit

To evaluate the governments fiscal situation,

analysts typically reference the total budget deficit the gap between total

federal spending (which includes interest on the national debt) and revenues. Now the CBO has come up with a new concept

to make it appear that the budget deficit is smaller than it actually is.

The CBO released a major report in February titled, The

Budget and Economic Outlook 2023-2033. It states that their

baseline budget projections are meant to provide a benchmark that policymakers

can use to assess the potential effects of changes in policy; they are not

intended to provide a forecast of future budgetary outcomes.

The cumulative deficit for the 20242033 period is

projected to total $20.2 trillion, or 6.1% of GDP. Since 1973, the annual

deficit has averaged 3.6% of GDP. In CBOs projections, deficits equal or

exceed 5.5% of GDP in every year from 2024 to 2033. Since at least 1930,

deficits have not remained that large for more than five years in a row.

CBOs projection of the deficit for the full year of

2023 was $1,410 trillion (Page 6 Table 1.1). However, the CBO added a new line

item called PRIMARY DEFICIT, which is defined as: the deficit

without counting the interest the government pays on its debt.

Primary

deficits deficits excluding net outlays for

interestincreased from 2.9% of GDP in 2023 to 3.4% in 2024 and 2025 in CBOs

projections.

This is a new and misleading concept to convince the

media and novice analysts that the U.S. budget deficit is not rising due to

higher interest rates. Yet higher interest rates the government pays on its

debt will greatly increase the real budget deficit. Whos kidding whom?

This graph from the Peterson Foundation tells the true story:

Market Comments:

Critical for the Feds future agenda is Gold not

moving up above $2000, and the U.S. Dollar index (DXY) staying above 100. These

price levels must be watched closely.

Any move above or below the stated levels will mean a significant event

is occurring.

Gold does best when GDP is decreasing, along with the CPI and

corporate earnings, as that portends the next steps for the Fed will be

easing!

Therefore, I still believe long Bonds, Gold, and Silver, while short stocks are the

best portfolio for a recession, which

I believe will begin this quarter.

The markets currently assume a +25 bps increase in

Fed Funds to be announced after the FOMC May 3rd meeting. That

+25-bps rate hike is now fully discounted with a 98.4% probability according to

CME Fed Funds forecast tool.

ΰThat rate hike will reinforce the recession and add more

firepower to this portfolio.

.

Sidebar: Earnings Estimates coming down but still too

high!

The NY Times notes that the outlook for corporate

profits has swiftly deteriorated. Wall Streets forecasters expect that S&P

500 profits in the first three months of 2023 fell almost 7% from a year

earlier, according to estimates collected by FactSet. That would be the second

consecutive quarterly decline, and the biggest since a severe though brief

slump in the early days of the coronavirus pandemic in 2020.

Continuing worries about inflation followed by bank

failures in March have soured the outlook for corporate profits, which are a

major driver of stock prices. Businesses

have also told investors to dial down their expectations, with 78 companies in

the S&P 500 offering guidance about their results that are below the

average Wall Street estimates.

2023 EPS estimate for the S&P 500 remains $200, which

is 9% below consensus estimates,

according to B of A Global Research.

Despite a big downward revision in consensus estimates (-13%) since last June, B

of As Savita Subramanian thinks they still look too optimistic with the U.S. headed

for a recession.

B of A analysts are watching tech spending, which

they expect to decrease. They estimate about 20% of IT spending is from the

Financial Services sector, which is now looking to shore up capital in the wake

of the March turmoil in the banking sector.

B of A: 2023

consensus EPS is falling off the cliff, -13% since June 2022 S&P 500

historical FY2 EPS revisions vs. 2023 consensus EPS (2023 as of 4/9/23)

Source: BofA US Equity & Quant Strategy, FactSet;

Note: historical average based on 2001-2022

.

Conclusions:

Do you trust

the U.S. government?

As the great comedian George Carlin said, The

quality of our thoughts and ideas can only be as good as the quality of our

language.

The so called Primary

Deficit is not an accurate measurement of U.S. fiscal health. It is totally misleading! This manipulation is to

fool the public at large.

When the recession kicks in, the deficit will be $3

trillion for fiscal 2023 on September 30th fiscal year end.

End Quote:

The words of the Billy Joel song Honesty should be read by the CBO leaders

and government officials:

If you search for tenderness, it isn't hard to find.

You can have the love you need to live. But if you look for truthfulness You

might just as well be blind. It always seems to be so hard to give. Honesty is

such a lonely word. Everyone is so untrue. Honesty is hardly ever heard. And

mostly what I need from you. I can always find someone to say they sympathize.

If I wear my heart out on my sleeve. But I don't want some pretty face to tell

me pretty lies. All I want is someone to believe. Honesty is such a lonely

word. Everyone is so untrue. Honesty is hardly ever heard. And mostly what I

need from you.

Billy Joel is an American singer, pianist, voice actor and songwriter.

.

Be well, stay healthy, wishing you peace of mind.

Please email the Curmudgeon (ajwdct@gmail.com) if you have any comments,

questions, or concerns. Till next time

...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2023 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).