Could Deteriorating Economic Fundamentals Overwhelm the

Fed’s Printing Press?

by The Curmudgeon

President Obama recently made a plea to Congress to avert

sequestration (forced federal government spending cuts), saying it will cost

both domestic and defense jobs. However, it appears that both parties believe

that sequestration, scheduled for March 1st, will take place in

spite of the President’s plea for the spending cuts to be averted. The U.S. government is facing a $16 trillion deficit

while spending 32 percent more money each year than it takes in (this works out

to 30 cents of borrowing for every US dollar spent by the federal government).

For over 1 month now, the Curmudgeon has wondered how

the stock market could continue to ignore the huge risk sequestration poses to

U.S. GDP (and corporate profits).

But that's not the only negative fundamental. Gasoline prices at the pump have climbed for

32 consecutive days to reach a four-month high. The national retail gasoline

price has risen 43 cents, or 13 percent, to $3.73 per gallon since Jan. 17th,

according to the Automobile Association of America (AAA). The price is much higher in CA with regular

gas going for $4.06 per gallon. Pundits have said that soaring gasoline prices

act as a tax on consumers who then have less money to spend on other

things. Consumer spending accounts for

70% of GDP.

Food prices are also rising. A sharp jump in the cost of vegetables led

wholesale prices to rise at a seasonally adjusted rate of 0.2% in January

compared with the previous month, the biggest increase since last summer, the

Labor Department said on February 20th.

The Producer Price Index for finished goods, which is one

of several gauges of inflation, had dropped for three straight months,

including a 0.3% decline in December, before January's rise. The main driver of

January's increase was a 0.7% jump in food prices. The costs of fresh and dry

vegetables are up 39% from December. Add

in a 15.2% rise in gasoline prices this year on top of the expiration of the 2%

FICA tax holiday, and this will hit the economy especially hard in the coming

quarter.

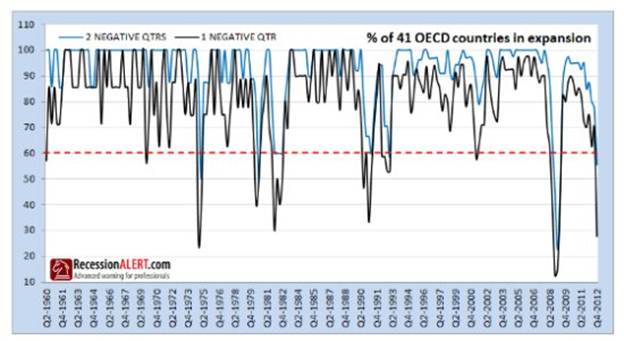

Meanwhile, the “world”- as defined by 41 OECD countries

around the globe - has suddenly plunged into recession as per this chart:

The chart covers a period between 1960 to the present. The

black line measures a single negative quarter-on-quarter GDP, while the blue

line measures the more traditional two consecutive GDP negative quarters

back-to-back. The fact that the

overwhelming majority of OECD nations are experiencing negative GDP growth has

caused commodities and precious metals prices to decline sharply in recent

days. Note also that U.S. export growth

will be hard to come by with the majority of the world in recession.

Could the U.S., which experienced slightly negative GDP growth in the 4th quarter, soon slip into recession? We think the combination forced federal government spending cuts coupled with high gasoline prices could easily tip the U.S. into recession this Spring or Summer.

The U.S. has reached the point where a recession is developing even after the Fed is printing $85 billion a month, most of which is flowing into financial markets rather than the real economy. If the U.S. does slip into recession, the Fed will have no bullets left to combat it. That's because the Fed has used up all their ammunition in the last four years by holding short term interest rates at zero and monetizing debt at an accelerating rate.

Yet there's a new school of thought that believes even a recession will not stop the upward move in stock prices, because that would cause Central Banks to supply even more liquidity to financial markets- either directly by buying stock index futures (which the Fed's plunge protection team was rumored to have done in Oct 2011) or buy printing money via debt monetization. That thinking implies that the upward trend in stock prices would continue even if the U.S. plunged into recession and corporate profits dropped significantly.

Fiendbear recently asked the

Curmudgeon if we'd see Dow 16,000 with 10% unemployment. The Curmudgeon didn't have a definitive

answer to that question.

Till next time.................................................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.