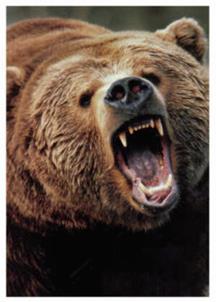

Growling Since 1996

Daily Market Report Page (10/21)

Weekly Market Summary Page (10/21)

Year End 2022 Summary Page

(12/31/23)

Year End 2022 Summary Page

(12/31/22)

Year End 2021 Summary Page

(12/31/21)

Year End 2020 Summary Page

(12/31/20)

Year End 2019 Summary Page

(12/31/19)

Year End 2018 Summary Page

(12/31/18)

Year End 2010 Summary Page

(12/31/10)

Year End 2009 Summary Page

(12/31/09)

Year End 2008 Summary Page

(12/31/08)

Crash of 2008 Weekly Summary Page

(10/13/08)

Crash of 2020 Weekly Summary Page

(03/13/20)

Crash of 2020 Weekly Summary Page

(03/20/20)

Click here for latest quotes for the week

Previous Week's Commentaries: Monday;

Tuesday; Wednesday; Thursday; Friday

Current

Links of Interest

Zhitong: US stocks too

strong? Wall Street warns: may face "lost decade" (10/21)

Murry

N. Rothbard: The Edict of Diocletian: A Case Study in Price Controls and

Inflation (10/14)

Sperandeo/Curmudgeon:

Chinese Stimulus “Bazooka” Blasts Stocks Higher as Gold Soars Above 2,600

(09/30)

Curmudgeon/Sperandeo:

A Politically Motivated Fed Rate Cut and Election Uncertainty Threaten the

Markets (09/23)

Sperandeo/Curmudgeon: Existential Risk: Ukraine Using U.S. and U.K.

Long Range Missiles Inside Russia (09/16)

Sperandeo/Curmudgeon: The Fed, GDP, Fiscal Policy, Wealth

Destruction and Markets (09/09)

Sperandeo/Curmudgeon:

Reliable Market Valuation Gauge Tops Extremes of 1929 and 2000 Bubbles (09/02)

Sperandeo/Curmudgeon: U.S.

Financial Markets Ignore Risks, Especially U.S. November Elections (08/26)

Curmudgeon/Sperandeo: U.S.

Stocks Stage a Huge Recovery as Recession Fears Suddenly Fade (08/19)

Curmudgeon/Sperandeo: Is it Too Late for the Fed to Overcome the

Sahm Rule and Prevent a Recession? (08/13)

Sperandeo/Curmudgeon: The

Fed Flops Again and Markets React! (08/05)

Sperandeo/Curmudgeon: A

Super Shocker from the July 25-27th Bitcoin Conference! (07/29)

Sperandeo/Curmudgeon: The

Markets and Economy vs. November U.S. Elections (07/22)

Sperandeo/Curmudgeon: World Peace, Economies

and Markets are Dependent on Geopolitics (07/15)

Sperandeo/Curmudgeon: UK and France Elections

Upset Status Quo; Will Biden Drop Out? (07/08)

Sperandeo/Curmudgeon: Will Chaos at the GOP and Democratic

Conventions Disrupt Financial Markets? (07/01)

Curmudgeon: Big Tech

Stocks Outperform; Stocks vs Bonds; a Perma-Bear’s Warning (06/26)

Curmudgeon/Sperandeo: Are

U.S. Equity Markets Bullish or Bearish? (06/24)

Curmudgeon/Sperandeo: Can

Anything Be Done to Reduce U.S. Budget Deficits/Debt and Alleviate Geopolitical

Tensions? (06/24)

Sperandeo/Curmudgeon: Blow-off Spring Rally Led

by Fewer and Fewer Stocks (06/17)

Curmudgeon: Large

Cap U.S. Stocks Have Big Gains, but Market Divergences Prevail (06/10)

Sperandeo/Curmudgeon:

Analysis of BLS, Gold Sell-off, U.S. Stocks and Bonds (06/10)

Sperandeo/Curmudgeon:

Inflation and Recession Watch, Fed Rate Cuts, Market Review and Outlook (06/03)

Curmudgeon: Divergences

Galore in U.S. Equity vs. Credit Markets (05/28)

Sperandeo/Curmudgeon: Update on Reverse Repos

and a Possible U-turn in Fed Policy (05/27)

Sperandeo/Curmudgeon: U.S.

Policy Changes and Across the Board Trickery Fuel the Rise in Risk Assets

(05/20)

Curmudgeon/Sperandeo:

Stock vs Bonds, Inflation Watch, Consumer Sentiment and Geopolitics (05/13)

Curmudgeon/Sperandeo:

Hopes of Fed Rate Cuts Buoy Stocks (05/06)

Sperandeo/Curmudgeon:

An Academic Analysis of Gold’s Historical Value (04/30)

Curmudgeon: China Futures

Firms Propel Gold Market to All Time Highs (04/25)

Sperandeo/Curmudgeon: Analysis

of Middle East Conflict; the Fed, Markets and “Uniparty” (04/22)

Curmudgeon/Sperandeo:

Middle East Conflict Expands; Implications for the Markets (04/15)

Sperandeo/Curmudgeon: Gold

and Oil Price Rises Driven by Geopolitical Tensions and Increased Global

Defense Spending (04/08)

Sperandeo/Curmudgeon: What

if Taxes and Interest Rates were included in U.S. Inflation Metrics? (04/01)

Curmudgeon/Sperandeo:

Has Fed Tightening Since 2022 Accomplished Its Objective? (03/27)

Sperandeo/Curmudgeon:

Outlook for U.S. Government Spending, Inflation, Fed Funds; Bullish on the

Markets with a Note of Caution (03/25)

Curmudgeon: 2024 Global

Liquidity and Monetary Aggregates Rise While Corporate Debt Defaults Soar

(03/18)

Sperandeo/Curmudgeon:

Despite Fed’s Efforts, Inflation is Still Out of Control (03/18)

Curmudgeon: 2024 AI Fueled

Stock Market Bubble vs 1999 Internet Mania? (03/11)

Curmudgeon: 2024 BLS and

Fed Subterfuge; Inflation Gauges, Fed Funds Forecast & Impact on the

Markets (03/11)

Sperandeo/Curmudgeon:

Should an Investor Buy and Hold the S&P 500? (03/04)

Curmudgeon/Sperandeo: Did

a New York Court Ruling Violate the U.S. Constitution? (02/26)

Sperandeo/Curmudgeon: CPI Revisited, Market

Comments, Higher Rates Increase Deficit and Debt (02/19)

Sperandeo/Curmudgeon:

Finagling the CPI; S&P 500 at New High with Ultra Complacency (02/12)

Sperandeo/Curmudgeon:

January New Jobs Conundrum and Outlook for the Markets (02/02)

Sperandeo/Curmudgeon:

Clandestine Role of the Fed in Increasing Liquidity (01/29)

Sperandeo/Curmudgeon:

What’s Driving Stocks to New All-Time Highs? Fed Watch and Recession Odds

(01/22)

Curmudgeon/Sperandeo:

Middle East Regional Conflict Expands; Influenced by Iran and Qatar (01/16)

Sperandeo/Curmudgeon:

BLS Fake Job Reports; Excess Liquidity Boosted U.S. Economy in 2023

(01/08)

Sperandeo/Curmudgeon:

2023 Year in Review, Market Forecasts and Asset Allocation for 2024

(01/02)

If you are asked to register to access a website, go to www.bugmenot.com and

get an ID/password that already exists.

Current Market Data

Charts provided

by BigCharts.com

Current

Market Data: Dow averages, S&P 500, Nasdaq, and bonds

Current

Market Data: Gold, Oil, CRB, sector indices, NYSE adv/dec, and dollar index

Current Market Data: Adv/dec, 52 week

highs/lows, volume data

Overnight

Quotes: S&P 500 (premium and settlement), gold, and currencies

CME

GLOBEX Flash Quotes (S&P 500, Nasdaq 100, Euros, currencies)

Inflation

Calculator From DollarTimes$

Favorite Web Sites

|

|

|

|

|

|

|

Market Charts, Data, and Statistics |

|

|

|

|

|

Newspapers, Magazines, and News Wires |

|

|

|

|

Weekly Charts

Dow Jones Industrials (10/18)

red line - 50 DMA; green line - 200 DMA; pink line - NYSE adv/dec

green line - Dow 21 DMA; red line - 50 DMA

NASDAQ Composite (10/18)

red line - 50 DMA; green line - 200 DMA

green line - 21 DMA; red line - 50 DMA

S&P

500 (10/18)

red line - 50 DMA; green line - 200 DMA; pink line - NYSE VIX

Archives

The Magic Wand of Liquidity Page

(02/16/21) [MZM data no longer available]

Fiend's Bear Encounters (1939-42, 1973-74,

1981-82) Page

DJIA, adv/dec, and momentum data

from 1990 to 10/16/24

Market Top of 1968 Revisited

Business Week's The Death of Equities Revisited

Tj's Financial Cartoon Gallery

Miki's Portraits of Some

Bulls of the Millennium

This page was last updated on October 21, 2024.

![]()

Send comments or questions to the Fiend

Send comments or ideas to the Cartoonist

A picture of the Fiend

The Fiend's Summer1998 Vacation Page

The Fiend's Spring 1999 Vacation Page

The Fiend's Summer 2000 Vacation Page

Finally -- Some dive photos

Since May 7th, 1997, this page has been accessedtimes.